Meet Lucy, your virtual credit analyst assistant designed to get more customers approved!

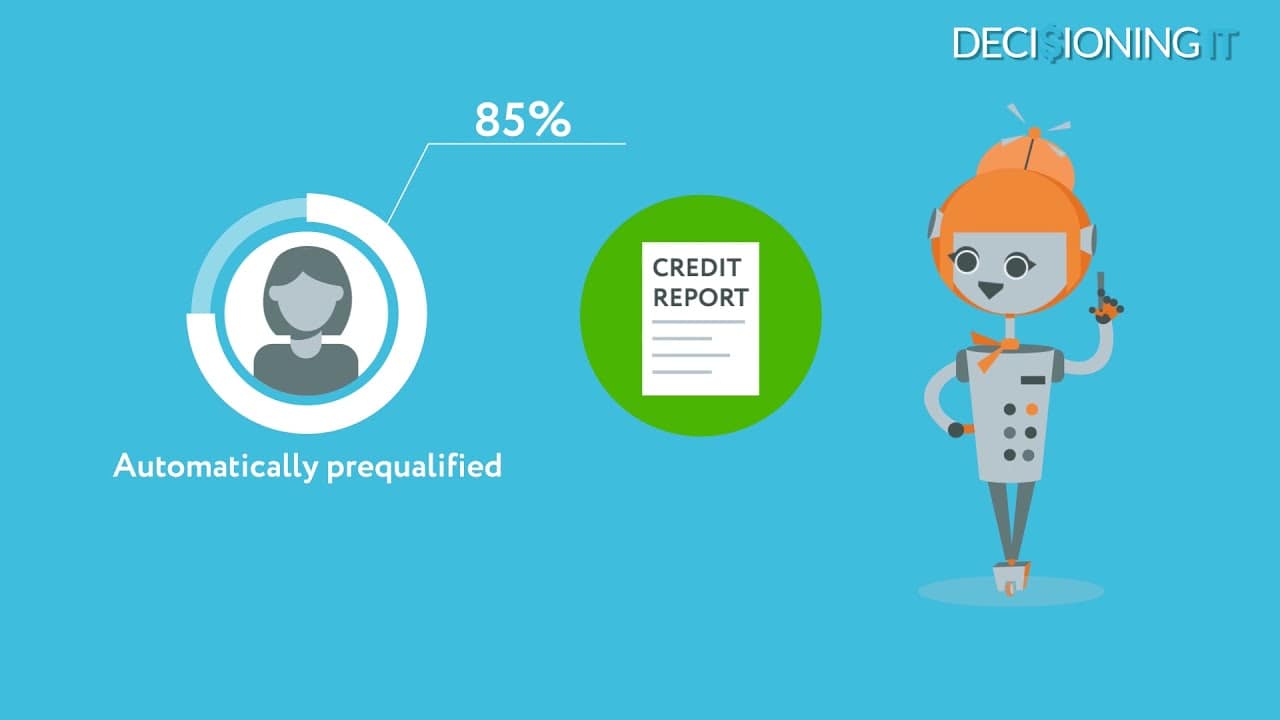

Get 85% of customers automatically pre-approved for vehicle loan in only 16 Seconds, regardless of their credit history.

Lucy gets 85% of customers

automatically pre-qualified Lucy finds the best reserves

and interest rates Analyzes lender pre-calls

and finds matching inventory

Join the satisfied dealers that use the Lucy F&I Platform!

Let's get started to know more

Lucy was built by dealers, for dealers !

Lucy was built and used by dealers for 5 years prior to its commercialization in April 2021. We already have a proven track-record:

increase in sales

customers automatically pre-qualified regardless of their credit history

creates the optimal deal structure in 16 seconds (incl. reserves and bonus)

Average Rating of over 4.8

Lucy is the market leading tool trusted by customers all over the world.

LUCY is very practical. Notes on files, lender conditions, customer credit analysis (useful to break client expectations before being more gentle).

Lucy is an essential tool for non-prime F&Is working in car dealerships. Crazy Lucy as we often call her will help us on several factors in our daily routine. Lucy allows me to forward complete files to collaborating institutions in just a click of the mouse.

In August 2020, Lucy was able to approve 21 clients of which we made 10 sales. These are 10 sales that we couldn't have done without Lucy. Our ROI is very high since the profitability generated by these non-prime sales largely exceeds the platform cost.

When I get non-prime clients, Lucy really helps me. The lender conditions are also very useful.

I love the fact that Lucy has paperless documents, automatic reminders, text messaging. Lucy boosted my production by at least 20% and that’s without counting on the automated credit decisions she produces!

© All rights reserved - DecisioningIT Canada