ATLANTA – (source) While consumer confidence might be mixed, Cox Automotive discovered more access to credit last month for potential vehicle buyers who needed it — especially if they had stronger credit backgrounds.

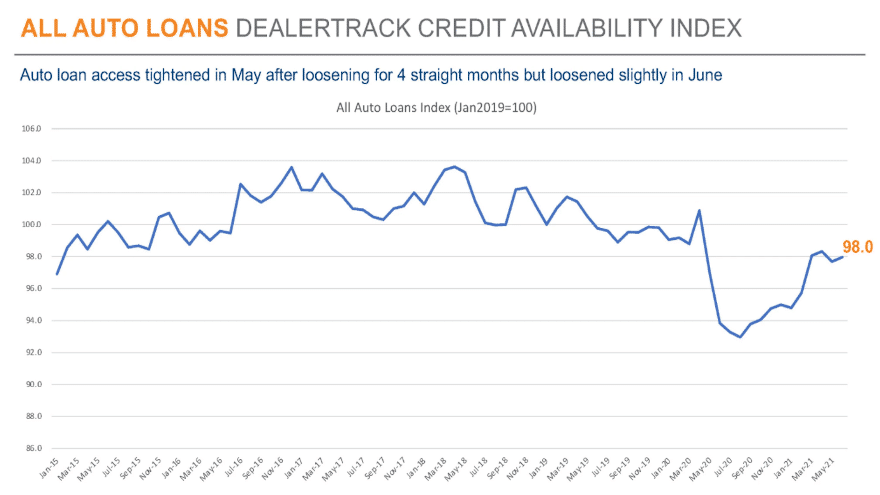

According to the newest Dealertrack Auto Credit Availability Index released this week, credit for auto financing improved modestly in June after tightening in May. Cox Automotive said the index increased 0.3% to 98.0 in June, reflecting that auto credit was easier to get in the month compared to May.

Analysts explained that credit availability expanded 4.4% year-over-year. However, when compared to February 2020, they said access actually was tighter by 1.2%.

As far as the collateral attached, Cox Automotive indicated that credit availability for financing to deliver certified pre-owned vehicles improved most while access to credit to complete a new-model transaction loosened the least.

How much the strategy might have helped the CPO market is detailed in this mid-year rundown of certified sales authored by Auto Remarketing.

No matter if it was a used or new vehicle, analysts added that non-captive finance companies loosened underwriting parameters most in June.

“Credit standards movement was more varied across lender types in June,” Cox Automotive said in the report that accompanied the latest index reading.

Credit accessed was unchanged at captives, loosened only slightly at banks and credit unions, and loosened the most at auto-focused finance companies. On a year-over-year basis, all lenders had looser standards,” analysts continued.

“Auto-focused finance companies have loosened credit access the most year-over-year. Compared to February 2020, only auto-focused finance companies were looser in June, and credit unions had tightened the most,” they went on to say.

Cox Automotive reiterated that each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in June, yield spreads narrowed, the share of terms longer than 72 months increased, and the down payment size declined, which all made credit more accessible,” analysts said.

“However, the approval rate, the subprime share, and the negative equity share all declined, and those factors moved against credit expansion,” they added.

To wrap up the latest index report, Cox Automotive revisited a topic quite familiar to all of us, since analysts pointed out that COVID-19 cases are increasing again. And as a result, the latest measures of consumer sentiment are mixed.

“The trend in daily new COVID cases reached a low for the pandemic in mid-June, but the rapidly spreading Delta variant caused an increasing trend in the last two weeks of the month,” Cox Automotive said.

Analysts mentioned that consumer confidence according to the Conference Board increased 6.1% in June and left confidence down just 4% compared to February 2020.

Cox Automotive also said plans to purchase a vehicle during the next six months improved modestly but remains down year-over-year. The company added that plans to purchase a home also improved in June but remains down year-over-year.

“The index of consumer sentiment from Morning Consult did not reflect similar improvements in June,” analysts said. “That index failed to see any stretch of consistent gains, and ended the month down 0.6% from May, which ended down 0.9% from April.

“The Morning Consult Index ended June down 12.1% from Feb. 29, 2020. This index is timelier, representing the full month each month, and is based on a much larger sample of consumers,” Cox Automotive went on to say.