Humans have been thriving on innovation since the dawn of time. Technology innovation was a game changer in human lifestyle, and we haven’t looked back since. With an array of technological solutions for almost every problem, technology began to grow, as did human expectations. Following that, several organisations emerged with more innovative solutions. However, only a few companies made it to the top level to be referred to as innovative. It takes a lot to get to that level, from ROI analysis to customer experience.

As a result, the “Top 50 Most Innovative Companies to Watch in 2022” is featured in the current issue of CEO Views. The list includes some of the most innovative technological companies, each of which provides best-in-class services. The proposed list is intended to help individuals and organisations find the best firms to help them realize their projects.

DecisioningIT Named Top 50 Most Innovative Companies to Watch in 2022

DecisioningIT: Revolutionizing Financial Institutions with Predictive AI

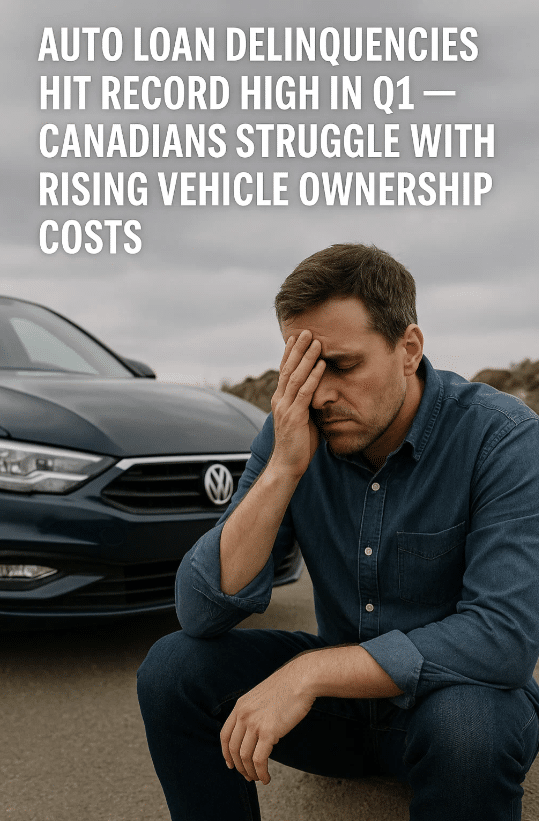

Irrespective of whether it’s an individual or a business, we all need credit at some point in our life. It might be for the expansion of your business or meeting your personal needs, you need to be able to access credit when required. And on the other side, financial institutions need to be very careful about to whom they are disbursing credit and understand the risks associated with them. Credit scoring is one of the most important analytical models used in any country to know the creditworthiness of the borrowers.

Credit reports help lenders to determine whether the borrower is a good candidate for the credit or not and how to structure the credit. However, credit scoring models are not infallible, and, in many instances, decisions can’t be taken only based on the credit profile, they need a robust mechanism for that. This is the problem statement DecisioningIT is trying to address with their, already popular, product Lucy.

Andre-Martin Hobbs, CPO & Co-Founder and Rosa Hoffmann, CEO & Co-Founder of Decisioning IT were with the CEOViews team speaking about their journey and how their product is helping financial institutions make informed decisions.

Story of inception

Andre-Martin Hobbs has been the VP of a group of Montreal-based dealerships for the past 12 years. Several years ago, he asked his top 5 Business Managers to look at 5 different client files and tell him how they would structure the deal: Which lenders, vehicles, and F&I products they would sell to their client. They all surprised him with different scenarios! According to business managers’ experience, these files get even more complicated for consumers that do not have a prime credit profile and the process is long and varies a lot.

This incident got him thinking that there is a need for a tool that would understand the history of a client and provide a report on how to structure credit for them.

Introducing Lucy!

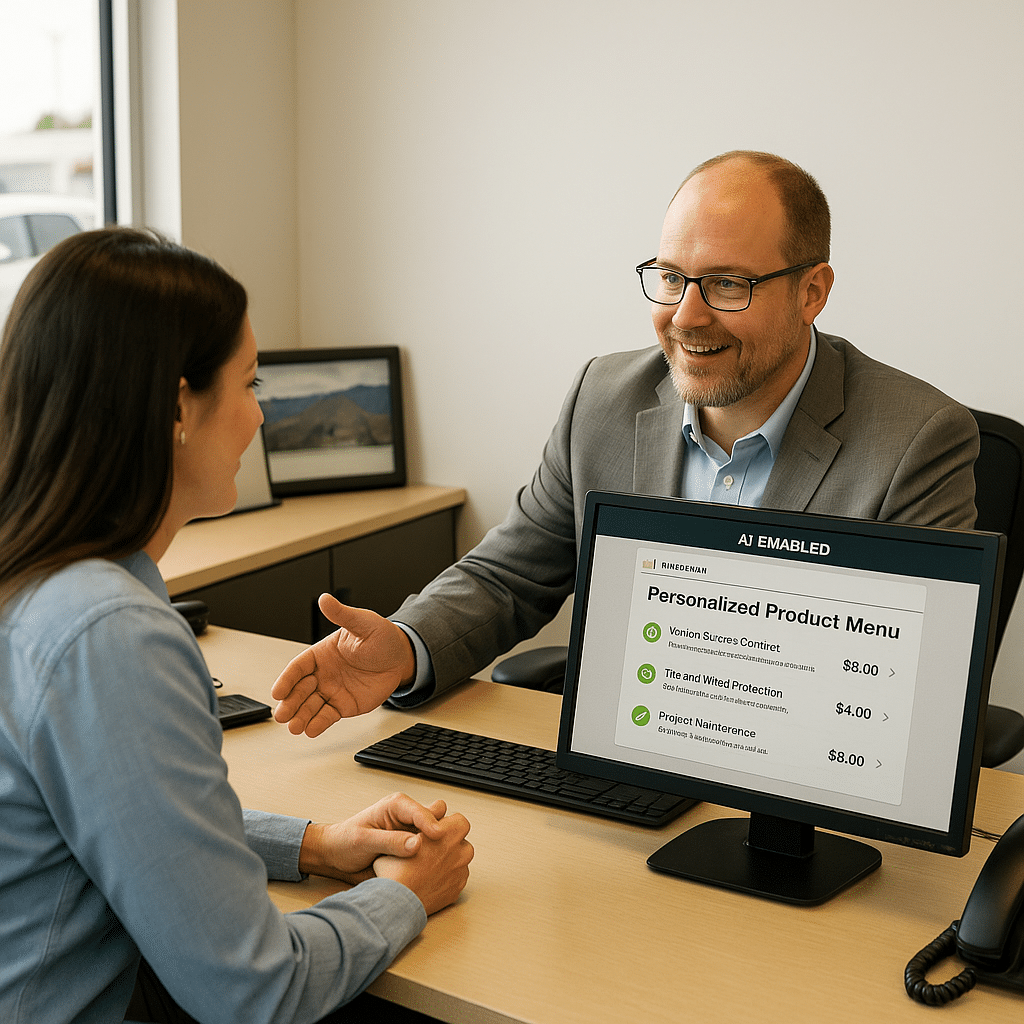

Soon, Andre-Martin Hobbs started working on the tool and called it Lucy. This tool would assist Business Managers with their credit appraisal and lender & vehicle selections. This helps them to speed up the process which raises consumer satisfaction. Following the vision of Rosa Hoffmann, CEO at DecisioningIT, they are now focused on bringing this unique technology online, so consumers can access Lucy and get prequalified in real-time. Lucy pre-qualifies 85% of consumers in just a few seconds, regardless of their credit history. Experienced Business Managers can’t go over 70% and the process takes up to 4 hours.

Their journey so far

The journey of success is the process of working through each step to arrive at the next one, with each step motivating and inspiring you to press on without fail. Ambitious entrepreneurs would never say that they have succeeded in doing what they wanted and the same goes for Andre-Martin Hobbs and Rosa Hoffmann. While they have already started integrating the product with some of the biggest players in the automotive industry, they describe this as just the beginning. It took almost 6 years of pure R&D and building Machine Learning models before being satisfied with Lucy’s decision. During that time, they worked closely with several dealers across Canada to pilot the solution and have been constantly improving it. When it was released, they gained quick adoption by dealers, coast to coast as a result of which Lucy was adopted by more than 100 dealers within a few months. To be called close to success, they are aiming at going fully operational in several countries which would take a little more time and work.

Trends in the industry

The shift in consumer purchase behavior to the web has put pressure on solution providers to cater to their needs. Everyone turned to the web when COVID-19 hit, including vehicle purchases. 10% of consumers buy their cars online presently and the trend is growing. This trend puts dealers, lenders, and manufacturers in an ecosystem to accommodate consumers’ needs and adopt new technologies such as cloud hosting, blockchain, machine learning, customer identification tools, e-signatures in a critical situation.

Adapting to these trends is very important to build a sustainable business. And for this, the strength that is keeping them alive is uniqueness. There are no other products like Lucy in North America, and they are continuously working on making it better, day after day. And he would add outstanding customer service as they train & educate dealer Business Managers for free, as part of the offer. Machine Learning and Cloud instances are advanced technologies they are using to offer the best solutions for clients.

Work culture

DecisioningIT’s core management team has several years of startup experience. Their team is rock solid and works together in perfect harmony. Clients see it and live it. They are all part of a bigger play, which is their clients’ satisfaction. They are keeping the end objective in mind, which is to satisfy dealer clients and consumers when accessing financing.

They are currently expanding their client base in Canada. Also, they are planning to enter the US market this year as well and have plans for Europe and South America in the coming years. All these and their expected funding round this year makes it an exciting company to watch.