API Solutions

Pre-qualify 85% of your online customers, regardless of their credit history.

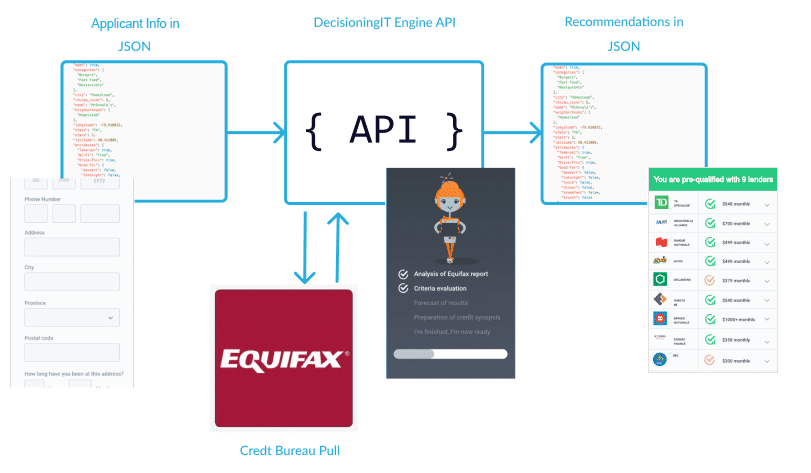

Too often, digital retailing falls short on subprime consumers and the online process ends abruptly. Our APIs can be added to your workflow at the beginning of the financing process or when your prime lenders have declined the consumer.

Our APIs will pre-qualify consumers using long or short credit bureau files and could also use bank statement pulls if required. We will return an open XML format with the list of lenders where the consumer is pre-qualified, including maximum payment and additional vehicle conditions based on lender programs.

Get clients pre-qualified at credit using our APIs and build your own forms to have full control over the look and feel of your website pages.

If you haven't done this integration yet, refer to our API-only integration guide.

Simplify the financing process

Simplify The Credit Application Process

You already operate a digital retailing solution, CRM, lender portal, classifieds website and would like to add credit pre-qualification to your workflow? Get access to APIs that get 85% of customers pre-qualified, regardless of their credit history.

Technology partners access our APIs, documentation, tools, and resources you need to build complementary solutions to address your customer needs.

Let's Work Together

DecisioningIT can add value to your business opportunities. Ready to partner with us? Contact us to join the DecisioningIT partner ecosystem.

What Our Customers Are Saying

LUCY is very practical. Notes on files, lender conditions, customer credit analysis (useful to break client expectations before being more gentle).

Lucy is an essential tool for non-prime F&Is working in car dealerships. Crazy Lucy as we often call her will help us on several factors in our daily routine. Lucy allows me to forward complete files to collaborating institutions in just a click of the mouse.

When I get non-prime clients, Lucy really helps me. The lender conditions are also very useful.

In August 2020, Lucy was able to approve 21 clients of which we made 10 sales. These are 10 sales that we couldn't have done without Lucy. Our ROI is very high since the profitability generated by these non-prime sales largely exceeds the platform cost.

I love the fact that Lucy has paperless documents, automatic reminders, text messaging. Lucy boosted my production by at least 20% and that’s without counting on the automated credit decisions she produces!