ATLANTA – Cox Automotive’s newest updates of indexes that track auto financing showed mixed developments with regard to dealerships being able to get their potential buyers financed and providers’ appetite to build portfolios.

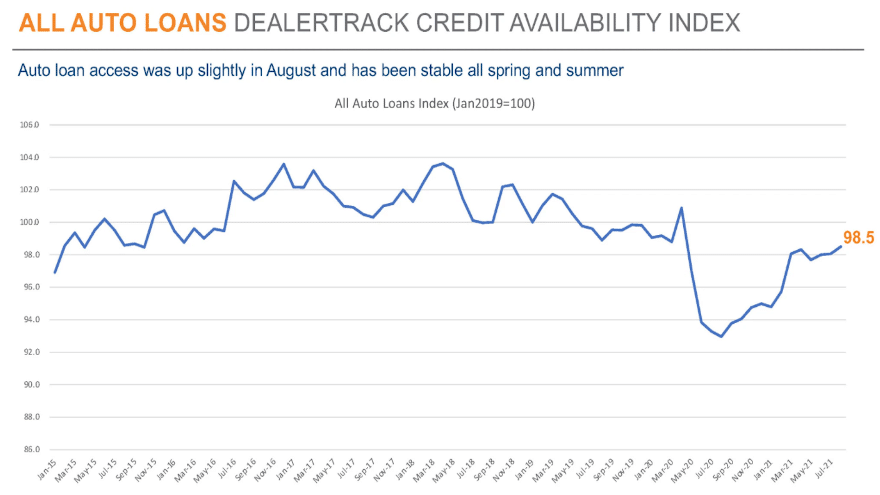

First, according to the Dealertrack Auto Credit Availability Index, analysts indicated access to auto credit expanded slightly in August at both franchised and independent dealerships retailing new and used vehicles financed by banks, captive, credit unions and providers that do not hold consumer deposits.

The index ticked up 0.4% to 98.5 in August, reflecting that credit was slightly easier to get in the month compared to July.

Cox Automotive added that access was looser by 6.0% year-over-year, but compared to February of last year, access actually was tighter by 0.7%.

“Across all auto lending in August, the share of terms longer than 72 months increased, the negative equity share increased, and the yield spread narrowed, and the moves in those factors made credit more accessible,” analysts said in commentary that accompanied the latest index update.

“However, the approval rate declined, the subprime share declined and the down payment size increased, and those factors moved against credit expansion,” they continued.

Each Dealertrack Auto Credit Index tracks shifts in loan approval rates, subprime share, yield spreads and contract details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Meanwhile, the Cox Automotive/Moody’s Analytics Vehicle Affordability Index went in the opposite direction.

With market dynamics leading to record prices and at least a decade-low for the month of August in incentives, Cox Automotive and Moody’s Analytics determined that new-vehicle affordability declined again in August.

“Without improving incomes, the decline in affordability would have been even worse,” said in commentary connected with that index, which revealed that the number of median weeks of income needed to purchase the average new vehicle in August increased to 37.7 weeks from a downwardly revised 37.3 weeks in July.

Cox Automotive and Moody’s Analysts pointed out that most factors moved against new-model affordability in August.

“The price paid moved higher and incentives declined while rates moved slightly higher, but estimated median incomes increased. With all financing factors increasing, the estimated typical monthly payment increased to a new record high, which was up 16% year-over-year,” analysts said.

“With the decline in August, new-vehicle affordability was much worse than a year ago when prices were lower and incentives were much higher. Affordability in August was worse than at any month covered by the index data, which dates to January 2012,” they went on to say.

According to a new report from Kelley Blue Book, new-vehicle prices hit another all-time high in August, marking the fifth straight record-setting month.

At $43,355, the average transaction price (ATP) for a new vehicle was up nearly 10% or $3,789 from one year ago and up 1.6% or $685 from July.

“The automotive industry is still reeling from the extraordinary circumstances of the last year and a half, setting new records seemingly left and right,” Cox Automotive analyst Kayla Reynolds said.

“With the ongoing inventory challenges that auto manufacturers are facing across the board, coupled with historically low incentive spending, car shoppers end up being the ones paying the price, quite literally. New-car prices just continue to climb, month after month,” Reynolds went on to say.