Lucy F&I Platform

Simplify The Credit Application Process

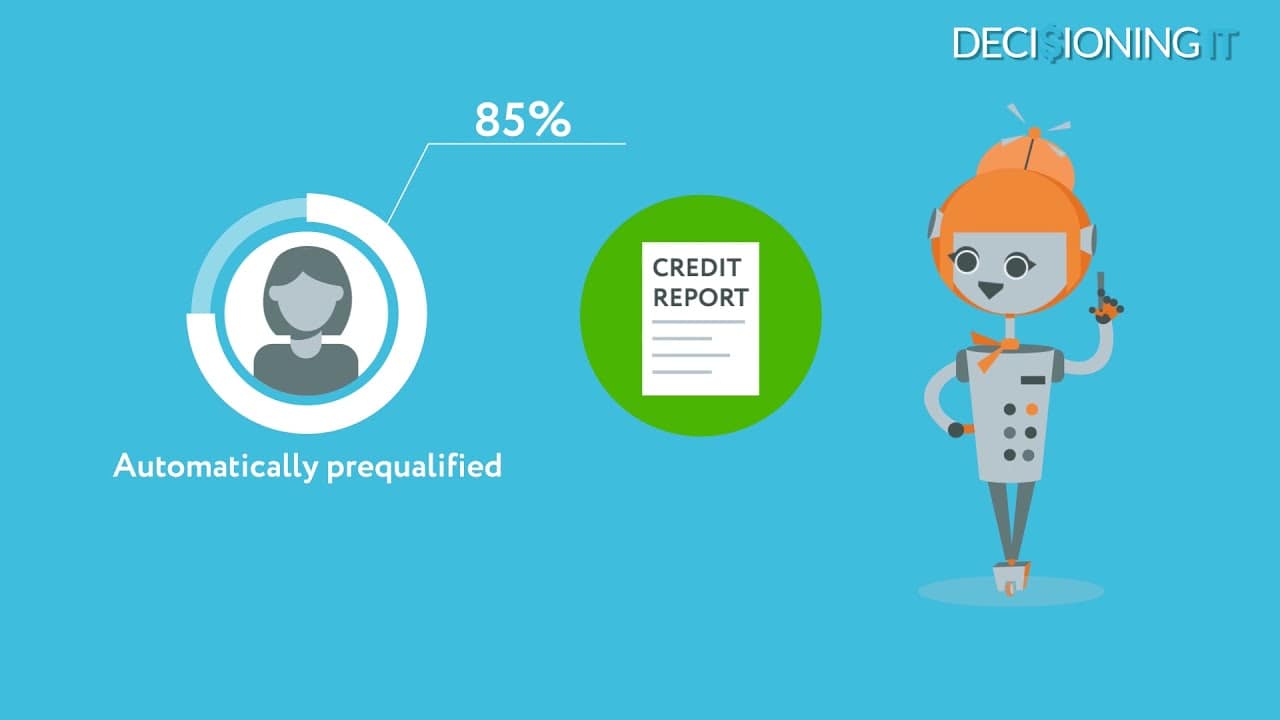

An automated decisioning platform that works in tandem with your dealership's DMS, CRM and portals. The Lucy Credit Decisioning Platform gets 85% of customers automatically pre-qualified, regardless of their credit history. It will keep clients active using nurturing tools, send automated reminders for clients and much more. This platform is designed to get more consumers approved, while managing the financing process from start to finish.

We live in a world that has an unimaginable amount of convenience and control over their retail experiences, making paperwork and credit management a troublesome and tiring experience. Up until now, there has not been any transparent and accurate financial solutions available for car buyers and dealerships.

Understanding the need of the hour, the Lucy Credit Decisioning Platform was designed to replace tough financial paperwork that can take hours with interactive machine learning and artificial intelligence predictions to facilitate your credit management.

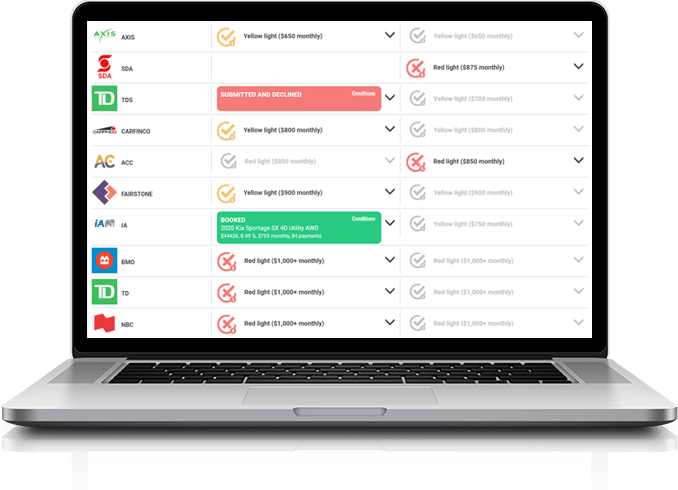

The platform provides an automated decision F&I platform that works in collaboration with your dealership’s distinct portals and related financial software, integrating seamlessly into your workplace.

At the same time, the platform, as an incredibly interactive and assistive tool, would continue to engage clients using a wide assortment of nurturing tools, send automated reminders, and much more. In short, Lucy has been designed to get more consumers approved by their financial institutions while managing the entire process with its reliable digital hands.

Prime

Non-prime

Inventory

Additional Tools

Training

On top of training modules, FAQs, and support ticketing, the Lucy Platform users are welcomed with a kick-off 4-hour training and get weekly follow-ups from our trainers once installed. Finally, level 1 and level 2 F&I managers are always available to help to unblock urgent transactions.

Testimonials

I am somewhat new to this trade and had the chance to start my F&I career using Lucy. Lucy validates my deals, makes sure I make no mistakes and the tutorials have helped me catch on much faster.

I don’t know what I would have done without Lucy!

I have 15+ years of experience as a non-prime credit specialist. I liked to say I knew every lender program, every trick there is to make sure my clients secure financing. But I have to say, Lucy makes me go faster every day, her suggestions are always accurate and her advice is really helpful. I don’t have to memorize every lender program change anymore!

The Lucy F&I Platform has been created by dealers, for dealers.

Proof is in the pudding and the Lucy Credit Decisioning Platform was built and used by dealers for 5 years prior to its commercialization in April 2021.

In a nutshell, the platform is driven by a cutting-edge AI engine that provides F&I managers with options other products simply cannot do. The idea is to help less experienced F&I managers with their sales while saving time for experienced F&I managers, for both prime and non-prime financing.

Let's get started

Join the satisfied dealers that use the Lucy F&I Platform!

The Lucy F&I Platform helps dealerships get 85% of their credit applications automatically pre-qualified and acts as a powerful CRM dedicated to F&Is.

- Daily updated lender programs

- AI powered credit decisioning

- Debt ratio calculators

- Inventory match on payment calls

- Nurturing and automatic reminders

What Our Customers Are Saying

LUCY is very practical. Notes on files, lender conditions, customer credit analysis (useful to break client expectations before being more gentle).

Lucy is an essential tool for non-prime F&Is working in car dealerships. Crazy Lucy as we often call her will help us on several factors in our daily routine. Lucy allows me to forward complete files to collaborating institutions in just a click of the mouse.

When I get non-prime clients, Lucy really helps me. The lender conditions are also very useful.

In August 2020, Lucy was able to approve 21 clients of which we made 10 sales. These are 10 sales that we couldn't have done without Lucy. Our ROI is very high since the profitability generated by these non-prime sales largely exceeds the platform cost.

I love the fact that Lucy has paperless documents, automatic reminders, text messaging. Lucy boosted my production by at least 20% and that’s without counting on the automated credit decisions she produces!

LUCY is very practical. Notes on files, lender conditions, customer credit analysis (useful to break client expectations before being more gentle).

Lucy is an essential tool for non-prime F&Is working in car dealerships. Crazy Lucy as we often call her will help us on several factors in our daily routine. Lucy allows me to forward complete files to collaborating institutions in just a click of the mouse.

When I get non-prime clients, Lucy really helps me. The lender conditions are also very useful.

In August 2020, Lucy was able to approve 21 clients of which we made 10 sales. These are 10 sales that we couldn't have done without Lucy. Our ROI is very high since the profitability generated by these non-prime sales largely exceeds the platform cost.

I love the fact that Lucy has paperless documents, automatic reminders, text messaging. Lucy boosted my production by at least 20% and that’s without counting on the automated credit decisions she produces!