The automotive finance sector continues to grapple with evolving market dynamics, as evidenced by the latest findings from TransUnion’s Q2 2024 Quarterly Credit Industry Insights Report. The report highlights a continued decline in subprime auto loan originations, a trend that underscores broader shifts within the auto financing landscape. This blog post delves into the key insights from the report and explores how these trends align with the future of auto financing, particularly in the context of advanced decisioning technologies like those offered by DecisioningIT.

Key Findings from TransUnion’s Q2 2024 Report

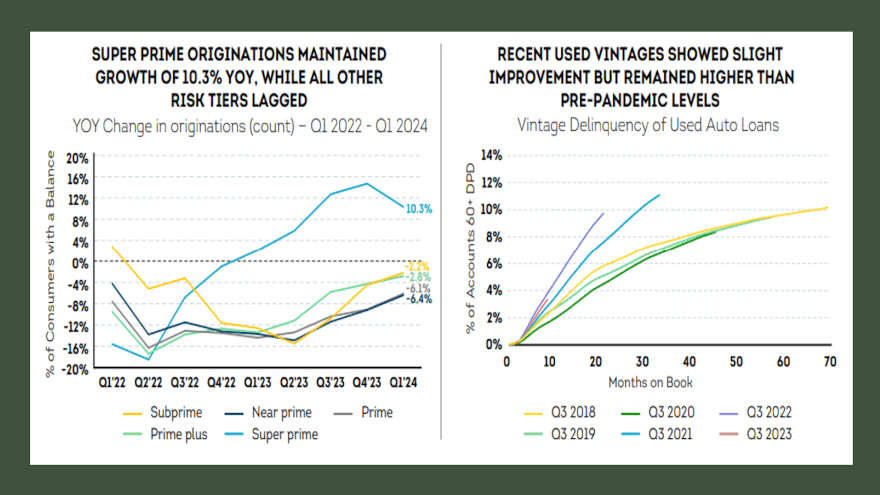

- Decline in Subprime Auto Loan Originations: The report reveals that auto loan originations in Q1 2024 stood at 6 million, a slight year-over-year decrease of 0.4%. However, the most significant decline was observed in subprime originations, which were down by a notable 27.4% compared to Q1 2019. This decline reflects ongoing affordability concerns and tighter credit conditions faced by subprime borrowers.

- Shift in Vehicle Origination Distribution: The distribution of new versus used vehicle financing is beginning to return to pre-pandemic levels. In Q1 2024, 40% of vehicles financed were new, while 60% were used. This is similar to the 41% new and 59% used ratio observed in Q1 2019.

- Stable Auto Loan Balances and Delinquencies: Despite the decline in subprime originations, total auto loan balances have increased by 2.7% year-over-year, reaching $1.6 trillion in Q2 2024. Interestingly, the average monthly payment for both new and used vehicles has slightly decreased due to vehicle price stabilization, with delinquencies ticking up marginally to 1.4%.

Implications for Auto Financing

The ongoing decline in subprime auto loan originations signals a need for adaptive strategies within the auto finance industry. As affordability remains a key concern for subprime borrowers, finance companies must explore innovative approaches to serve this market segment effectively.

- Enhanced Decisioning Systems: Companies like DecisioningIT can play a pivotal role in addressing these challenges by offering advanced decisioning systems that leverage AI and machine learning. These technologies enable more accurate credit assessments, potentially broadening access to credit for subprime borrowers while managing risk more effectively.

- Diversification of Loan Portfolios: To mitigate the impact of declining subprime originations, lenders may need to diversify their loan portfolios by targeting more stable credit segments, such as super prime, which saw a 10.3% increase in originations year-over-year.

- Focus on Consumer Education: As the report indicates, many consumers are still waiting for interest rate relief from the Federal Reserve. In the meantime, educating consumers on managing their credit health and preparing for potential future rate cuts could be crucial in ensuring they are well-positioned to take advantage of better financing terms when available.

The current trends in auto financing, particularly the decline in subprime loan originations, reflect broader economic challenges and shifts in consumer behavior. As the industry navigates these changes, leveraging advanced technologies like those provided by DecisioningIT will be essential in adapting to the evolving landscape. By focusing on innovative decisioning solutions and proactive consumer engagement, the auto finance industry can continue to thrive despite the challenges ahead.

Source: Transunion