The importance of maintaining good credit is a well-known principle in personal finance. Yet, a recent survey by BadCredit.org has uncovered that a significant number of Americans are not actively managing their credit health. The study, which polled 500 adults across the United States, sheds light on concerning trends in financial habits and knowledge amid today’s challenging economic landscape.

Neglecting Credit Reports

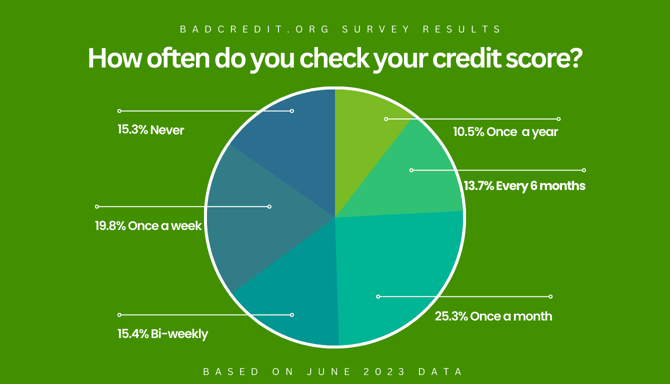

One of the most startling findings is that 27% of respondents do not review their credit reports at least once a year. Regular credit report checks are crucial for identifying errors, detecting fraudulent activities, and understanding one’s financial standing. Erica Sandberg, a consumer finance expert with BadCredit.org, emphasized the risks of this oversight:

“Not checking your credit score may seem minor, but it can lead to bigger problems, including missed opportunities to improve your financial situation or a chance to address issues as they arise, like fraud.”

Understanding Credit Utilization

The survey also revealed that nearly 26% of participants are unaware of the benefits of maintaining a low credit utilization ratio on their credit cards. Credit utilization—the percentage of available credit being used—is a significant factor in calculating credit scores. High utilization can negatively impact scores, while keeping it low demonstrates responsible credit management.

Coping with Economic Challenges

The current economic climate, marked by high interest rates and inflation, is forcing many to make difficult financial decisions:

- Reduced Spending: A significant 75% of respondents have cut back on their expenses to cope with the rising cost of living.

- Tapping into Savings: Nearly 41% have withdrawn funds from their savings accounts to stay afloat.

- Reassessing Financial Goals: About 72% have pivoted their financial plans or goals due to economic uncertainties.

These statistics highlight the widespread impact of economic pressures on individual financial strategies.

An Opportunity for Improvement

Despite the concerning trends, experts see this as a chance to enhance financial literacy. Bobbi Rebell, a personal finance expert at BadCredit.org, expressed optimism:

“The bottom line is we can learn something new about money each day, and it’s encouraging to see how much opportunity exists to help others make better-informed decisions and determine the right next steps so they can get back on track with their financial goals—especially in today’s economy.”

Moving Forward

The findings from BadCredit.org’s survey underscore the necessity for increased financial education and proactive credit management. By regularly reviewing credit reports, understanding credit utilization, and adapting to economic changes wisely, individuals can better secure their financial futures.

As the economy continues to present challenges, taking control of personal finances and seeking out educational resources can empower Americans to navigate uncertainties with confidence.

Note: This article is based on a survey conducted by BadCredit.org, aiming to provide insights into Americans’ financial habits and knowledge.