As we enter the fall of 2025, Canadian consumers are carrying heavier financial burdens than at any point since the last financial crisis. Inflation has cooled from its highs, but high interest rates, mortgage renewals, and record non-mortgage debt are leaving households stretched. For auto retailers, the data is clear: the coming months will bring more uncertainty, more declines, and more frustrated buyers.

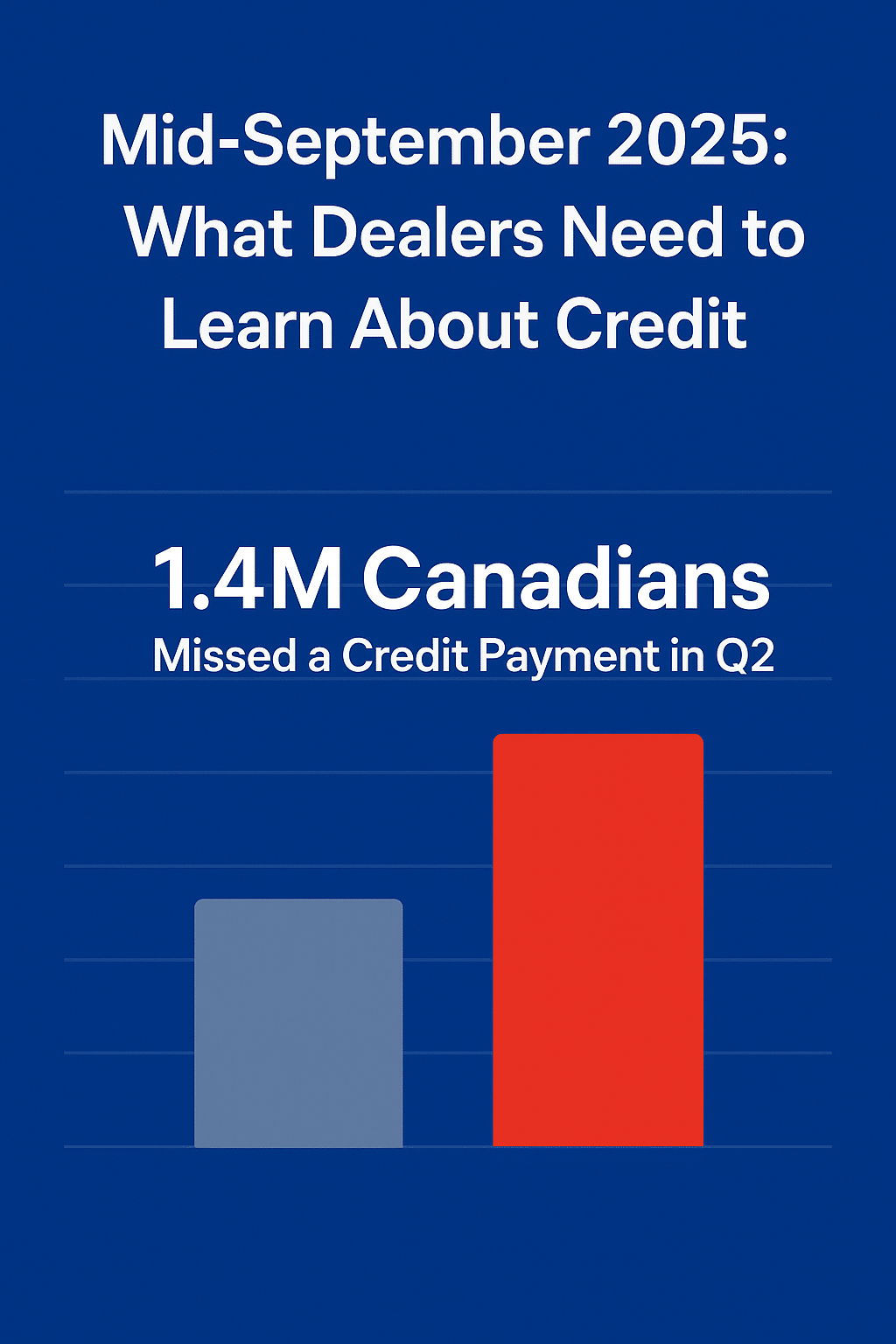

Missed Payments Are Still Climbing

In Q2 2025, Equifax Canada reported that nearly 1.4 million Canadians missed a credit payment — an increase of 118,000 over the same quarter in 2024. Non-mortgage borrowers are particularly at risk, with one in 19 falling behind compared with one in 37 mortgage holders. This widening gap shows how fragile many consumers are, especially renters and younger households without equity to lean on.

(Source: Equifax Canada, August 2025)

Auto Loan Risk Near Cycle Highs

The auto finance sector is showing the strain. TransUnion Canada’s data for Q2 2025 puts the 60-day past-due auto delinquency rate at 1.31%. That is higher than levels seen during the 2008–09 recession. Recent vintages of loans, even among near-prime and prime borrowers, are underperforming compared to pre-pandemic years. Dealers can no longer assume that “good credit” customers will be straightforward approvals.

(Source: TransUnion Canada, July 2025)

Insolvencies Continue Their Upward Trend

The Office of the Superintendent of Bankruptcy (OSB) reported 12,285 consumer insolvencies in July 2025, up 4.6% year-over-year. Nearly 80% were consumer proposals, a sign that Canadians are actively seeking to restructure debt rather than default outright. In Ontario, the year-over-year increase was even sharper at 8.8%. These numbers are an early warning that more households will arrive at dealerships with financial scars.

(Source: OSB monthly insolvency statistics, September 2025 release)

A Wave of Thin-File and New-to-Canada Buyers

At the same time, the market is seeing growth in new-to-credit consumers, many of whom are newcomers to Canada. These thin-file borrowers represent opportunity but also risk: TransUnion research shows they are nearly twice as likely to go delinquent within 12 months as pre-pandemic cohorts. For lenders, that means tighter criteria. For dealers, it means more surprises when approvals don’t come through.

The Lesson for Fall 2025

The lesson as we head into fall is that uncertainty is the new normal. Rising missed payments, elevated auto loan delinquency, increasing insolvencies, and a growing share of thin-file consumers all point to one reality: approvals are harder to predict. A customer who looked like a safe bet in 2022 may now be declined, and dealers who only discover that late in the sales process will lose time, trust, and profit.

Why Prequalification Needs to Be Standard

The answer is to move credit discovery forward in the process. Soft-pull prequalification gives dealers and customers clarity before negotiations or test drives. It doesn’t impact credit scores, but it sets realistic expectations about terms, down payment, and lender fit. This reduces last-minute declines, improves F&I efficiency, and protects customer satisfaction.

That’s why we built SAM. Already live at over 150 Canadian rooftops, SAM integrates on your website and in-store, performing soft pulls, routing deals to the right lenders, and feeding prequalified leads straight into your CRM. In today’s market, it’s not just a nice-to-have — it’s a safeguard against uncertainty.