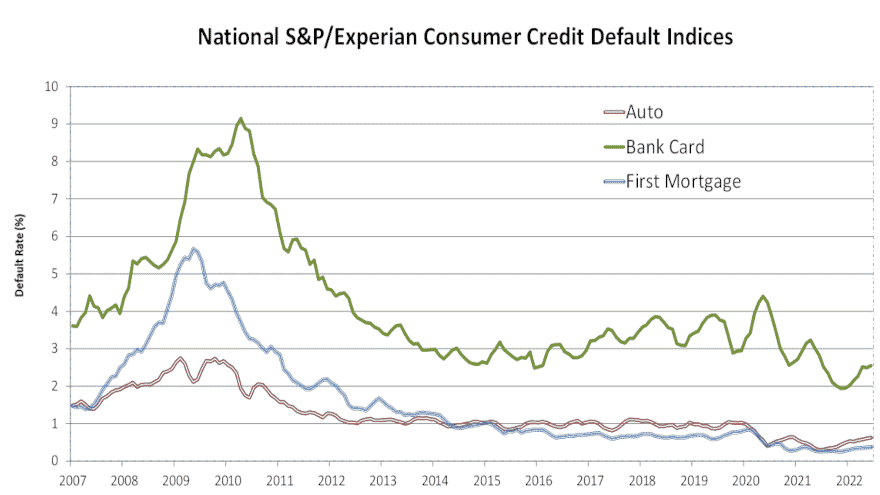

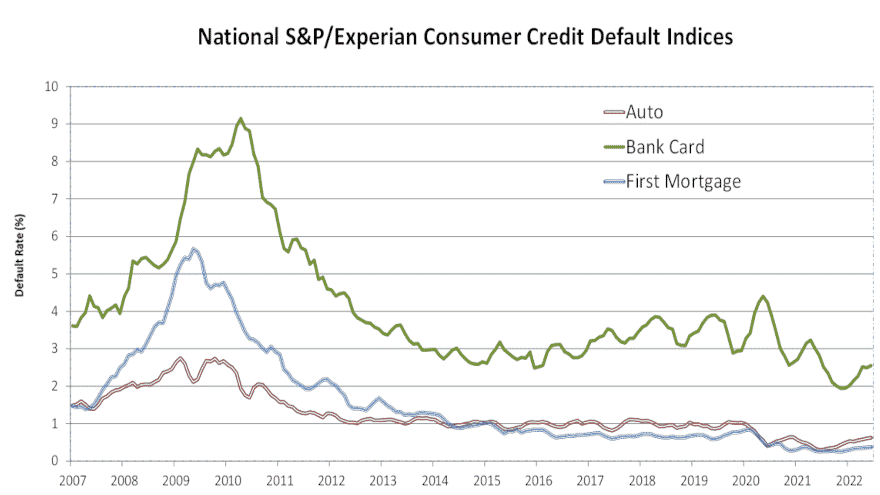

Auto Remarketing – Perhaps your portfolio is experiencing a bit more turbulence, but overall auto defaults are just 32 basis points higher than the all-time low set a year ago.

That metric surfaced on Tuesday when S&P Dow Jones Indices and Experian released data through June for the S&P/Experian Consumer Credit Default Indices.The auto default rate for June came in at 0.62%. Again, that’s 32 basis points higher than the all-time low of 0.30% recorded during the same month last year.

Despite increases during 11 of the past 12 months, the latest reading still is below the measurements the industry saw before the pandemic. According to the S&P Dow Jones Indices and Experian database going back a decade, the auto default rate stayed above 0.82% every month between May 2012 and February 2020.

The highest point during that stretch? It came in September 2013 when analysts reported the rate at 1.15%.

Elsewhere in the newest update, S&P Dow Jones Indices and Experian reported that the composite rate — which represents a comprehensive measure of changes in consumer credit defaults — ticked up 2 basis points to 0.53%.

Analysts said the bank card default rate climbed 6 basis points to 2.55%, while the first mortgage default rate also moved up 2 basis points to 0.38%.

Continue reading here: https://www.autoremarketing.com/subprime/auto-defaults-now-sit-32-basis-points-higher-all-time-low