Vehicle sales stabilized, incentives returned in pockets, and interest rates finally showed signs of easing. Yet beneath that surface calm, consumer risk continued to build. New data released by TransUnion and LendingTree makes that reality harder to ignore.

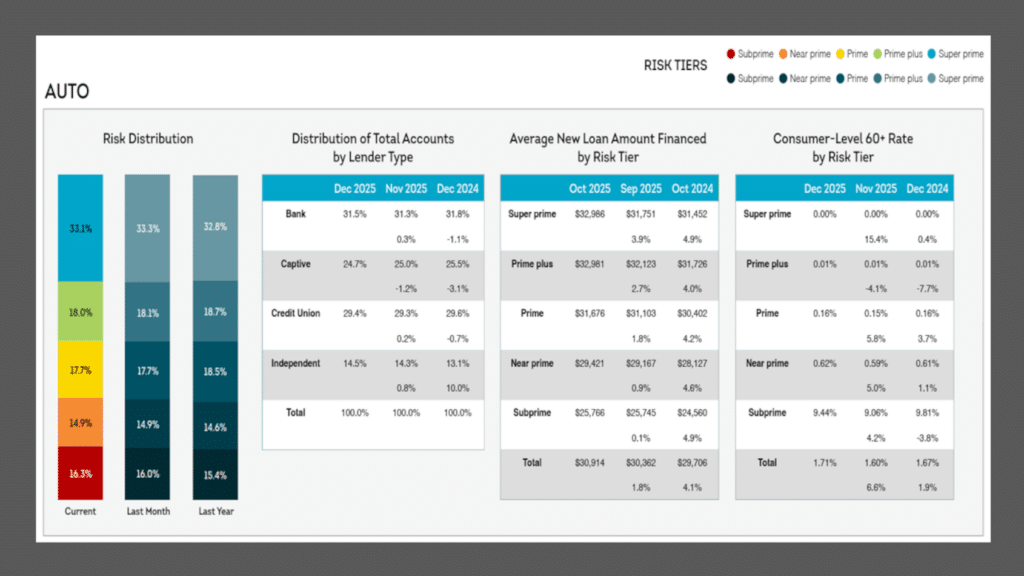

According to TransUnion’s December Credit Industry Snapshot, the average amount financed on an auto loan reached $30,914 in October, up sharply from both September and the same period a year earlier. Rising balances alone do not guarantee trouble, but delinquency trends suggest many borrowers are being stretched.

TransUnion reported that the share of consumers 30 days past due on auto loans climbed to 4.49% in December, a sequential jump of 17 basis points. More concerning for lenders and dealers alike, the 60-day delinquency rate also rose, reaching 1.71% by year-end.

Risk is shifting, not exploding

This is not a sudden shock to the system. What the data reveals instead is a gradual migration of risk across the credit spectrum.

Super-prime borrowers still make up the largest share of auto portfolios, but that segment’s growth has slowed. At the same time, near-prime and subprime borrowers now account for a larger portion of outstanding auto loans than they did a year ago. Subprime exposure alone rose to 16.3% of portfolios, up from 15.4% the prior year.

In other words, lenders are not dramatically loosening standards, but the mix of customers is changing. Combined with higher loan balances, even modest delinquency increases carry greater financial weight.

The same pressure is visible beyond auto finance. TransUnion noted rising delinquency rates across mortgages, bankcards, and unsecured personal loans, reinforcing the view that consumers are juggling multiple obligations at once rather than struggling in a single category.

Longer loans, heavier payments

LendingTree’s analysis adds another layer to the picture by examining how borrowers are managing those obligations.

Nearly half of Americans with auto loans now carry terms longer than 72 months, and more than 7% are stretched beyond 84 months. Gen X borrowers, in particular, are leaning heavily on extended terms and now post the highest monthly payments of any generation, averaging $594 per month. Almost one in ten Gen X borrowers pays $1,000 or more each month for their vehicle.

Gen Z borrowers, while holding smaller balances, are devoting a larger share of their income to car payments than any other age group. On average, they spend more than 13% of monthly earnings on their vehicle, leaving little room for error when unexpected expenses arise.

What this means for dealerships

For dealerships, these trends create a delicate balancing act.

On one hand, buyers still want and need vehicles. On the other, payment sensitivity is high, loan structures are more complex, and traditional credit signals are less predictive on their own. Approving the wrong deal carries higher downstream risk, while declining the wrong customer means lost volume and margin.

This is where decisioning technology becomes critical.

Why DecisioningIT and SAM matter now

DecisioningIT’s SAM platform is built for precisely this kind of environment. Rather than relying solely on static credit tiers or blunt approval rules, SAM helps dealerships and their lending partners evaluate risk dynamically, using richer data and adaptive decision logic.

With SAM, dealerships can:

- Identify early risk signals before delinquency materializes

- Match customers to the most appropriate financing structures in real time

- Reduce costly declines while protecting portfolio performance

- Maintain deal flow without compromising long-term outcomes

As auto-finance risk continues to rise gradually rather than catastrophically, success will hinge on smarter decisions at the point of sale. Dealers who understand not just who qualifies, but why and under what conditions, will be better positioned to grow through uncertainty.

The data is clear. The opportunity lies in how you respond.