Source: AutoZen

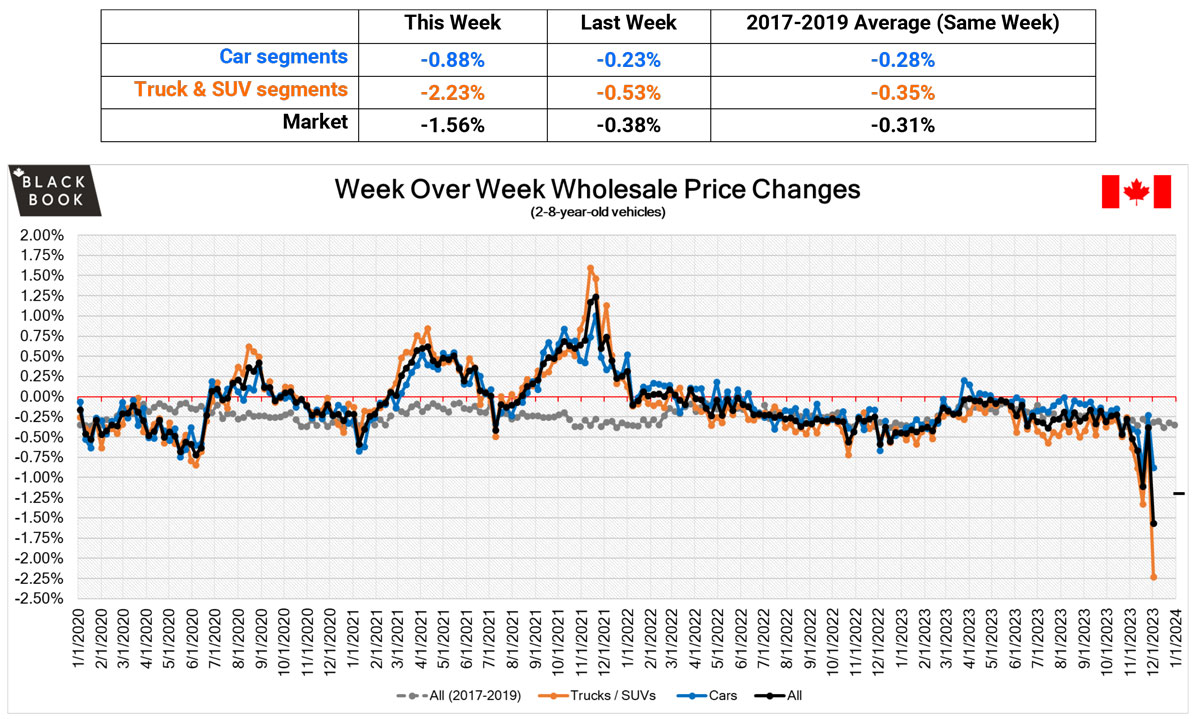

Autozen’s recent data provides critical insights into the used car market’s depreciation rates and factors influencing these trends. The average depreciation for vehicles on the platform is 6.2% year over year, a marked improvement from historical rates that witnessed a 20% depreciation in the first year and 15% in subsequent years before the chip shortage. The data showcases differential depreciation rates based on the type of vehicle and its country of origin. For instance, luxury vehicles have depreciated at 9.8%, while mainstream vehicles faced only a 4% reduction in value. When compared by the country of origin, US-made vehicles saw an 11% depreciation, whereas Japanese vehicles experienced just a 2.3% decrease.

Some brands, such as Porsche and Tesla, faced significant depreciation rates over the past year, at 28% and 30.5%, respectively. In contrast, brands like Nissan showed commendable resilience with a mere 4% depreciation year over year. Despite these fluctuations, many vehicles retain a higher percentage of their Manufacturer Suggested Retail Price (MSRP) than historically typical values before the chip shortage.

Multiple external factors have influenced these pricing changes, including the chip shortage, new car pricing and inventory levels, consumer willingness to pay, and interest rates. The chip shortage has especially influenced both new and used car markets, increasing prices due to reduced vehicle availability and driving consumers towards older, more reliable models.

Focusing on individual brands as case studies, Toyota’s strong reputation for reliability has led to it maintaining a high retained value, whereas Jaguar, a luxury brand, lags in this metric, though it still fares decently against pre-chip shortage benchmarks.

Looking forward, the used car market is expected to continue its gradual depreciation pace due to high interest rates anticipated throughout 2023. As new car inventory levels rise, they are projected to exert downward pressure on used car prices over the coming years. It is essential for buyers and sellers to understand these dynamics when considering their options in this ever-evolving market.

For those considering a purchase or sale, now offers unique opportunities. Selling a car can still capitalize on the relatively high values, while buyers need to be wary of high prices and interest rates. Meanwhile, the electric vehicle (EV) market remains volatile, with factors like Tesla’s price cuts and the influx of new models shaking up the landscape.

In essence, Autozen’s data brings clarity to a complex market landscape, aiding customers in making informed decisions by offering real-time insights into the used car market.