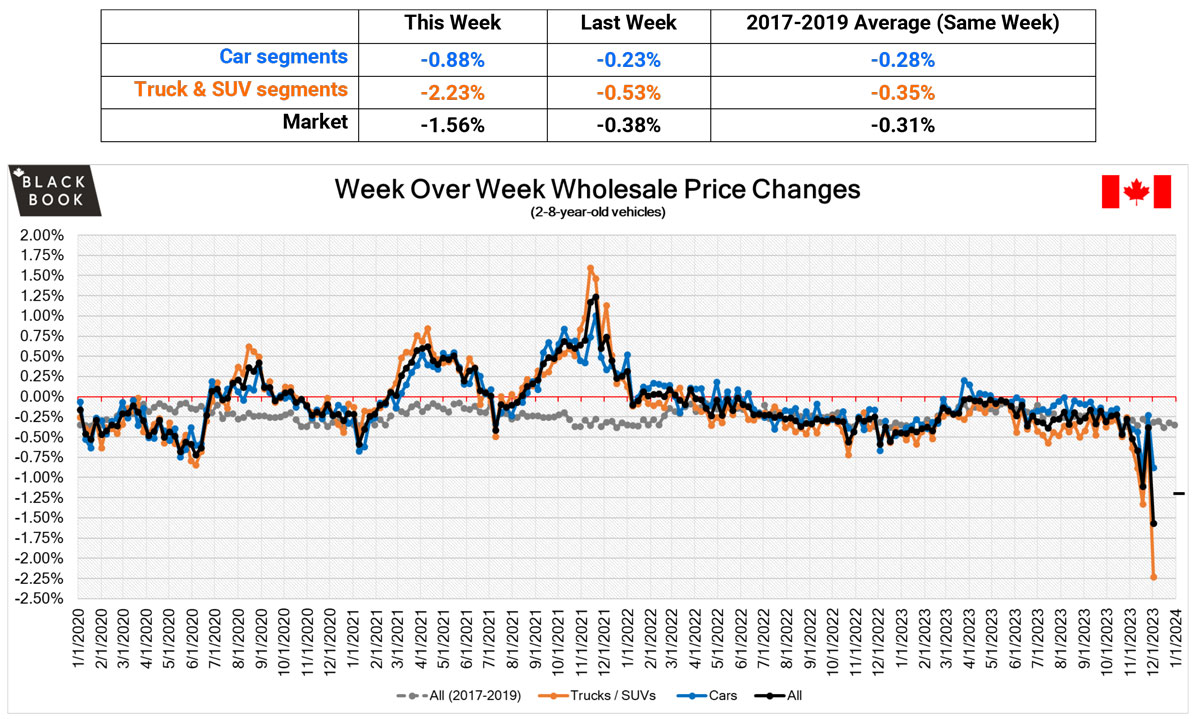

The Canadian automotive wholesale market witnessed a substantial decline last week, with average vehicle prices dropping significantly, marking the most considerable decrease of 2023. According to the latest data from Canadian Black Book (CBB), this decline surpassed six times the usual historical average.

For the week under review, the overall price drop averaged 1.62%, with cars seeing a decrease of 0.93% and trucks and SUVs experiencing a more significant fall of 2.28%. This trend reflects a deepening decrease across the Canadian wholesale vehicle market, as noted by CBB analysts in their recent report.

In an unprecedented occurrence, all 22 vehicle segments tracked by CBB experienced price reductions. Among these, larger vehicle categories like luxury compact crossover/SUVs and compact crossover/SUVs observed the most substantial declines, decreasing by 3.60% and 3.59% respectively. Similarly, full-size luxury crossover/SUVs and mid-size crossover/SUVs saw their prices fall by over 3%, with the small pickup segment, usually resilient, experiencing a 2.35% decrease.

The average decline for cars stood at 0.93%, with midsize cars registering the highest drop at 3.15%. Close behind were near-luxury cars and sporty cars, declining by 1.22% and 1.15%, respectively. Luxury compact cars showed the least reduction, dropping by just 0.33%.

CBB attributes the ongoing price drop to a combination of low supply and diminishing demand at auctions in both Canada and the United States. They note that upstream channels are absorbing supplies before they reach the wholesale markets, further impacting availability.

The value changes were significant, with most vehicle segments, particularly trucks and SUVs, experiencing over $100 in value decrease. CBB analysts observe that smaller vehicles are outperforming larger ones, potentially due to tighter consumer budgets and increasing arbitrage risks for exporters.

Conversion rates in auctions remain low, with CBB reporting sell rates ranging from 9% to 49%, although most hovered below 30%. The reluctance of sellers to lower reserve prices is contributing to these lower sell rates.

The average retail price for used vehicles in Canada also saw a week-over-week decline, with the 14-day moving average standing at approximately $37,870.

In comparison, the U.S. market also witnessed a decrease, with car and truck segments dropping by 1.86% last week, following a 1.49% decrease the previous week.

CBB’s global insights also touched upon Ford’s recent challenges, including strikes and new union agreements. The strike reportedly cut Ford’s profits by $1.7 billion USD, and the new contract is expected to cost the company $8.8 billion USD by 2028, roughly amounting to $900 per vehicle. CBB analysts suggest that balancing vehicle prices and profitability will be a significant challenge for Ford in the coming years.