As financial barriers begin to ease, new data reveals a positive shift for consumers and auto financing sectors grappling with affordability issues.

The latest report from Experian analyzing third-quarter figures shows a decline in financed amounts for both new and pre-owned vehicles. Used vehicles saw a significant drop in financed amounts at origination, with a decrease of $1,517 from the previous year, setting the figure at $27,167. New vehicles followed suit, with a decrease in financed amounts from $41,543 to $40,184 at the time of sale.

This trend reverses the sharp increase noted over the previous year, which saw a $3,698 rise in financed amounts for new vehicles from Q3 2021 to Q3 2022.

Despite the dip in financing amounts, average monthly payments for vehicle loans saw only slight hikes. The average monthly payment for new vehicles inched up by $25 to $726, and for used vehicles, the rise was a modest $4, reaching $533.

Interest rates have also risen, with new vehicle financing averaging at 7.03%, up from 5.26% the previous year. For used vehicles, financing rates averaged 11.35%, increasing from 9.38%.

“Observing the decline in average vehicle loan amounts provides a glimpse of relief,” commented Melinda Zabritski, Experian’s Senior Director of Automotive Financial Solutions. “Coupled with stable monthly payments amidst rising interest rates, there’s an emerging sense of optimism, with more financing options available to consumers.”

In a new development, consumers are opting for shorter loan terms for new vehicle purchases. Experian data reveals an increase in contracts ranging from 1 to 48 months, suggesting a strategic move by buyers to secure lower interest rates available for shorter durations.

Captives also saw a notable increase in market share, now accounting for the majority of the total financing market share at 30.43%, up from 21.55% in Q3 of the previous year. This shift indicates a growing preference for captive financing options among consumers.

Other key findings from the report include:

- Credit unions holding the largest market share for used vehicles.

- A slight reduction in average contract terms for both new and used vehicles.

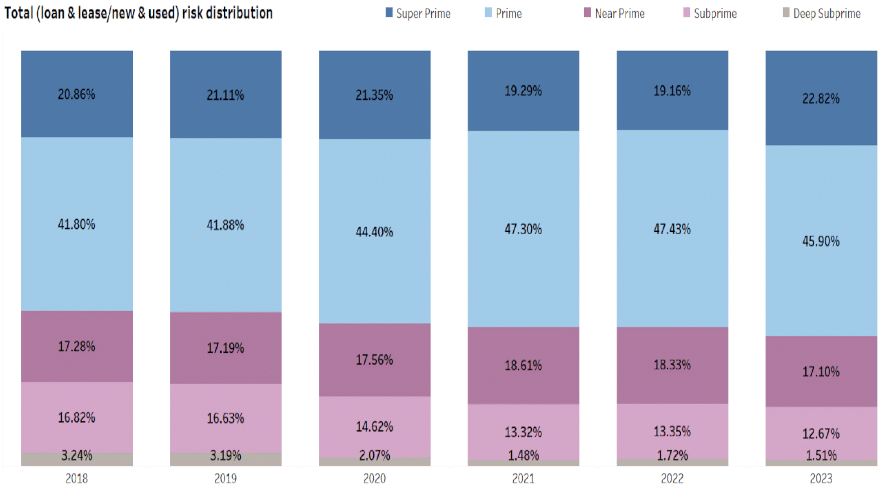

- Growth in prime and super prime financing, which now accounts for over 68% of total financing.

- Delinquency rates have shown an uptick, with 30-day delinquencies at 2.33% and 60-day delinquencies at 0.91%.

As the auto finance landscape evolves, these trends signal a gradual movement towards more manageable financing conditions, offering a respite for dealerships and buyers alike.