Unique market influencers and changing consumer preferences are impacting F&I.

AutoSphere – Over the last few months, the automotive industry has faced some unprecedented challenges.

The onset of the COVID-19 thrust economic uncertainty upon the sector in a matter of days, while stay-at-home measures (designed to curb the spread of infections) required automotive retailers to shut their physical doors and move as much of the transaction process as they could online.

In addition to that, a slump in demand for new vehicles, followed more recently by a surge and then a shortage of inventory as a result of supply chain and component disruptions, has created what might be called a seller’s market, the likes of which probably hasn’t been seen since the post-World War II era.

Eager buyers

Dealers are scrambling to get inventory and if they’re lucky enough to obtain it, have an eager pool of buyers, meaning that prices for both new and used vehicles have skyrocketed.

Yet from an F&I perspective what does this all mean? To find that out, Autosphere interviewed several F&I specialists to get their views.

At iA Dealer Services, George Steinsky, Vice President, National Sales, says that the shortage of new vehicles and consumer demand is impacting F&I in many different ways.

Firstly, if dealers are selling fewer cars each month they need to ensure that profit is sustained. Secondly, they can afford fewer missed opportunities for a sale and thirdly, the used market has seen transaction prices climb so rapidly, that it’s impacting the margin for selling F&I products to buyers of these types of vehicles.

Diana Ricketts, Vice President, Strategic Partnerships at LGM Financial Services, says that with fewer actual vehicle sales taking place today, it also provides an opportunity for dealers to take more time with their customers.

“Often,” she says, “F&I managers don’t get to spend a lot of time with the customer but with the current [situation] they can really focus on customer needs, asking questions to ensure the client is getting what they want. Typically,” says Ricketts, “that leads to higher product penetration and profitability.”

Steve MacIsaac Vice President, Sales, Ontario and Western Canada at Sym-Tech Dealer Services, notes that despite the disruptions caused by the pandemic and now the vehicle shortage, dealers should stick to a proven F&I strategy and process.

Yet he also acknowledges that the current situation also has more car shoppers considering products they might previously not have thought about. Some examples include job loss protection, disability insurance, perhaps an extended warranty if they plan on keeping the vehicle for longer.

Specific product demand

At iA, George Steinsky says he’s seen a notable uptake in GAP Insurance and Total Loss products in markets where there’s regulatory approval to sell them.

“We’ve also seen a large amount of interest across our suite of Ancillary Products,” he says. “Tire/rim and owner comfort products have driven a lot of volume for us over the past year.

On the used vehicle side, significant price increases have also impacted dealer profitability.

Currently, it’s hard for many dealers to actually assess the value of many used cars since the shortage of new inventory is putting so much pressure on wholesale prices. Additionally, such is the demand for vehicles overall, many trade-ins dealers might previously have wholesaled are being reconditioned and retailed instead.

From an F&I perspective, generally, the older the vehicle, the less the number of products can be offered since some won’t qualify and for those that do, their impact is often diminished.

“A lot of F&I products follow the rule of 10,” says Sym-Tech’s Steve MacIsaac. “If the vehicle is seven years old, it will qualify for three-year coverage.”

Nevertheless, in some cases, consumers might see the benefits in some products such as extended warranty coverage or paint protection, especially if they plan to keep the vehicle longer and minimize the potential of any negative equity they might have.

Online shift

Besides the current vehicle shortage, the pandemic also shifted much of the F&I process from the physical dealership to online, using digital and virtual tools.

Those that have been proactive in embracing the digital side of the process have seen significant benefits.

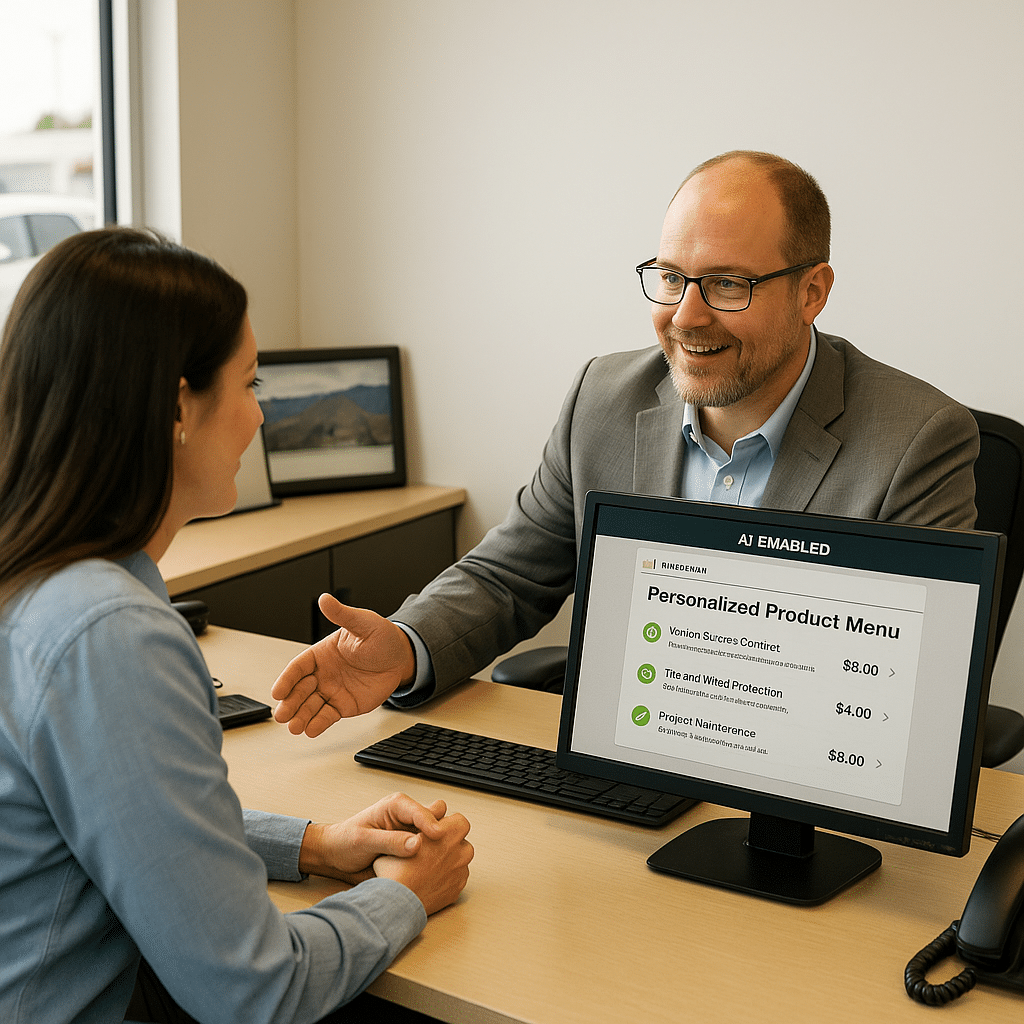

At LGM Financial Services, Diana Ricketts acknowledges that the greater use of online tools has allowed F&I managers the opportunity to better prepare for each customer, since they can ask them pre-emptive questions via email, text or chat, allowing them to better understand what the customer is looking for and tailoring product options to them—especially important considering that in many cases, consumers have already conducted a significant amount of research.

Additionally, taking this approach, also allows F&I managers to identify any potential gaps in their existing product coverage. As we exit the pandemic, how things will play out in the F&I space remains to be seen.

We will likely see more integration between the online and bricks and mortar aspect of the business office but ultimately, says Ricketts it’s about communication.

“It’s still going to be about taking a consultative approach. You know you want to make sure that you’re offering the information that the customer wants, and you’re offering the products that they need.”

Used Vehicle Trends

A key question on many minds at present is what is going to happen in the used vehicle marketplace as this has numerous implications for dealers, including F&I products and services.

Pierre Fauchille, Managing Director, Physical and Digital Solutions for Cox Automotive Canada, says that over the last 12-14 months, with volumes down at physical auctions, demand for cars in the U.S., as well as fluctuating exchange rates and a flood of online bidders on a smaller number of available vehicles–dealers have had to become quite creative when it comes to both buying and selling.

The access to digital tools and technology has provided some benefits, allowing dealers to cast their net wider in terms of sourcing vehicles.

For franchised dealers, the shortage of new vehicle availability can also provide them with an opportunity to make even more money on the used side, not only from would-be new car buyers but also from those who, as a result of the pandemic will no longer consider public transit for commuting and have chosen to purchase a vehicle.

Even if the vehicle might be older, some of these new buyers may not have the cash to pay for it, so as Fauchille, notes, there represents an opportunity for new financing and possibly protection products as well, not to mention after-sales service revenue.

Although it’s difficult to say how long the current inventory shortage will last, dealers should not expect things to change significantly in the next 6-12 months, meaning they will likely be able to sell used vehicles for a premium and with the right F&I products, make significantly more profit on everyone that’s sold.