9 million out of 28 million auto finance transactions involved electronic paperwork, Wolters Kluwer finds

Source: AutoNews – A third of all new and used auto financing deals last year involved an electronic contract, a figure reflecting a significant increase in digital paperwork last year, according to information and software provider Wolters Kluwer.

The number of auto finance originations using e-contracts rose by 1.6 million in 2021, a 44 percent increase from the 2020 volume seen on Wolters Kluwer’s eOriginal cloud platform, spokesman John Sternal of Merit Mile said.

And the pace of e-contracting adoption appears to be increasing.

The fourth quarter of 2021 saw 918,388 more auto finance deals use e-contracts, a 109 percent increase from a year earlier, according to Sternal. He said the first three months of 2022 posted a 122 percent increase.

“So the quarterly trend is showing a dramatic uptick in volumes and adoption as the year progresses,” Sternal wrote in an email Monday.

A separate Wolters Kluwer analysis, this one examining both internal and external data, calculated 9 million, or 33 percent, of 28 million auto finance transactions involved e-contracting in 2021.

“Lending transactions are being completed in many places today with new models emerging such as the adoption of EV, which caters to a more holistic digitized loan origination and document management process,” Wolters Kluwer auto strategy head Tim Yalich said in a statement. “In particular, lenders are now looking for seamless, automated and compliant ways to transact and secure the benefit digital offers over paper. Lenders, third-party providers and dealers are now leveraging digital ecosystems that are purpose-built to handle the auto finance industry’s origination channel diversity, eliminating the complexities around managing various multi-channel assets post-execution, and drastically reducing operational and time costs.”

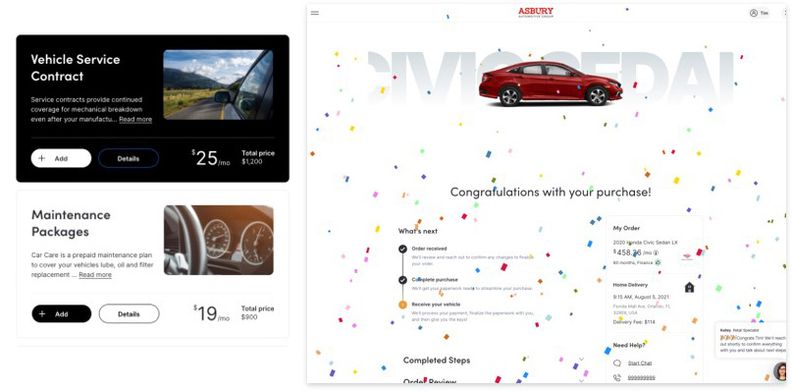

Wolters Kluwer also attributed part of the increase to consumers seeking used vehicles, noting that many large used-vehicle companies have adopted digital platforms.

“Whether auto finance and dealer service providers should implement digital technologies is no longer the question,” Wolters Kluwer wrote. “As the need for digitization continues to accelerate, leadership may instead focus on how quickly they can adopt the technology to avoid the risk of being left behind.”