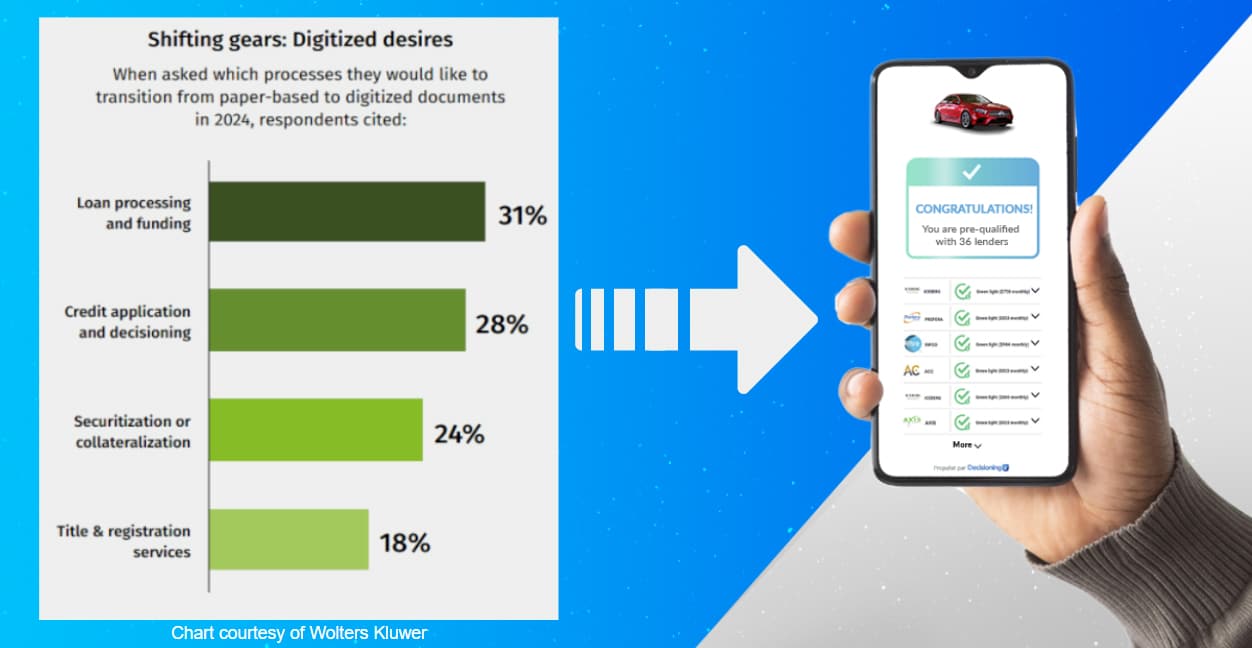

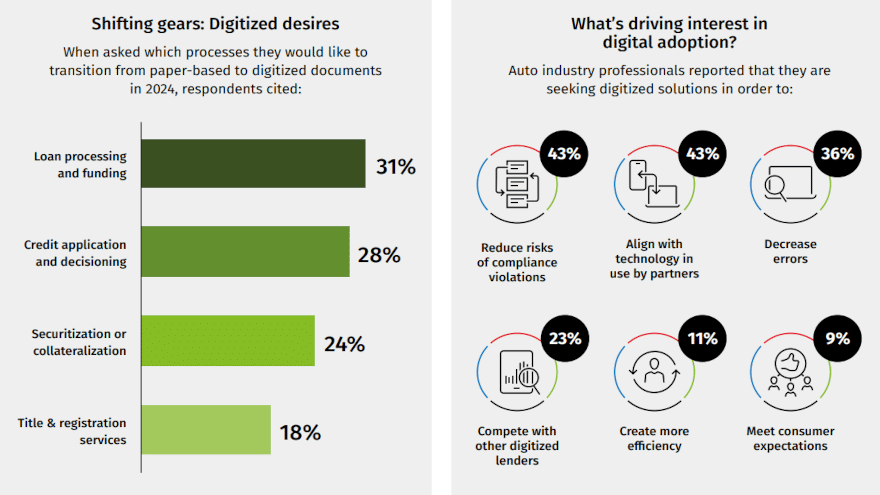

The automotive finance industry is at a pivotal juncture, with digital transformation reshaping traditional business models and consumer interactions. A recent industry survey, commissioned by Wolters Kluwer and echoed by independent research conducted by DecisioningIT, has brought to light the evolving dynamics and the pressing needs of automotive, dealer, and auto finance professionals, particularly in the realm of credit application processes.

The Current Landscape and Emerging Challenges

The survey, which engaged over 2,200 industry professionals, revealed a significant trend towards digital adoption, with 22.7% of respondents already utilizing digital finance solutions. However, the transition is not without its challenges. About 21% of respondents are still in search of the right digital solution, while 19.1% have not found a qualified provider to implement these solutions effectively.

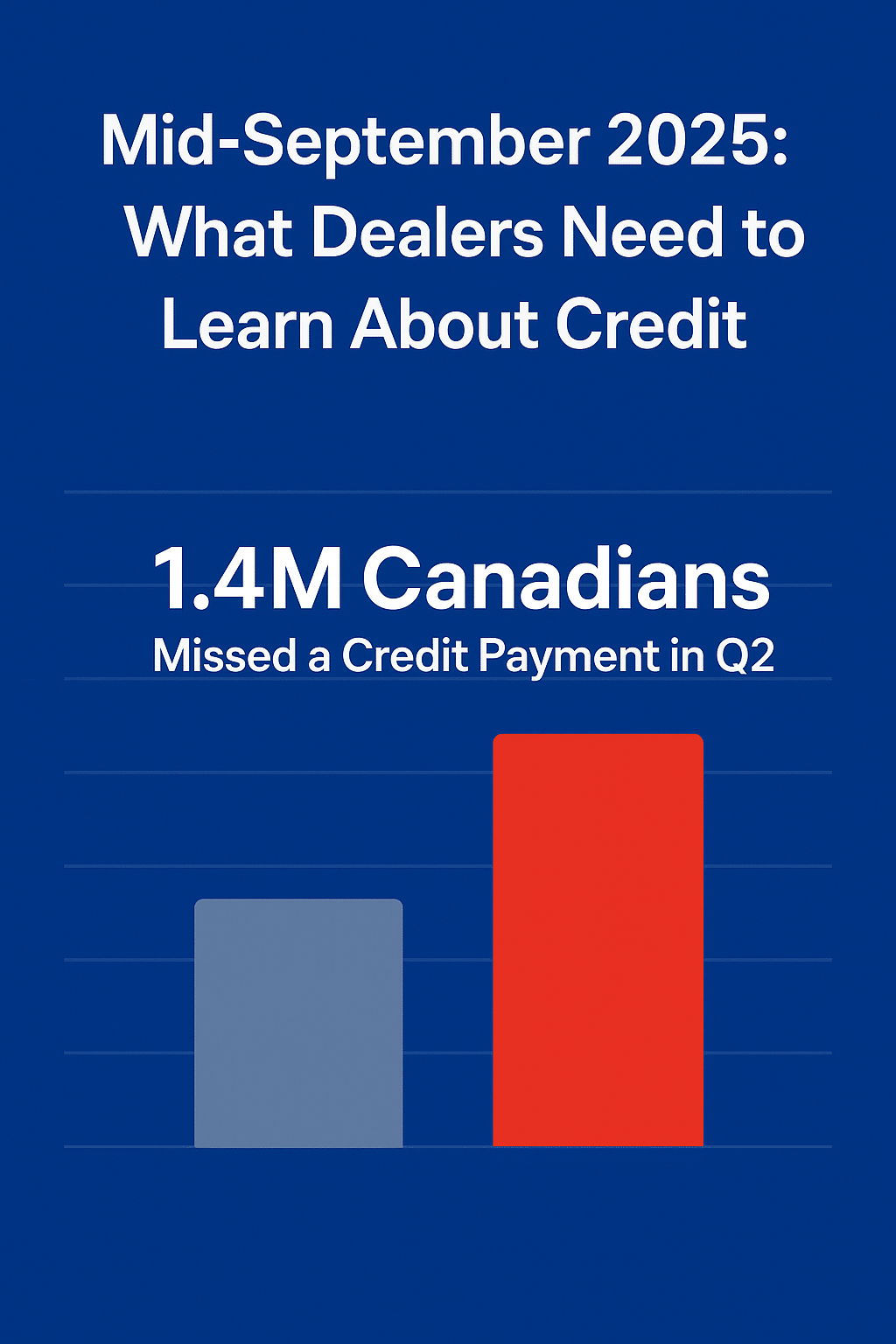

The need for efficient and streamlined credit application processes is more pronounced than ever. Dealers are increasingly recognizing the inefficiencies of traditional, paper-based methods. The survey highlighted that nearly half of the respondents admitted that about a third of their deals contain errors due to reliance on manual processes. This not only impacts operational efficiency but also significantly affects customer satisfaction and trust.

The Shift Towards Digital Credit Application Processes

As the industry gears up for 2024, a notable 28% of respondents expressed their intention to transition credit applications and decision-making to digitized documents. This shift is not merely a trend but a strategic response to the increasing demand for speed, accuracy, and customer satisfaction in the auto financing process.

The digital transformation in credit applications is not just about adopting new technology; it’s about redefining the customer journey, minimizing errors, and enhancing decision-making efficiency. Dealers are increasingly aware of the competitive edge that digital solutions offer, especially in an era where consumers expect quick, seamless, and transparent services.

The Strategic Imperative for Dealers

In light of these insights, the strategic imperative for dealers is clear. Embracing digital solutions for credit applications is no longer an option but a necessity to stay competitive and meet the evolving expectations of consumers. However, the challenge lies in choosing the right solution that is not only robust and comprehensive but also aligns with the specific needs and dynamics of the dealership.

Conclusion: The Case for DecisioningIT’s SAM Widget

In this transformative era, DecisioningIT’s SAM widget emerges as a strategic ally for dealers. It’s not just a tool but a solution designed with an in-depth understanding of the industry’s challenges and opportunities. The SAM widget stands out for its ability to streamline and optimize credit application processes, ensuring accuracy, efficiency, and compliance.

Dealers opting for the SAM widget can expect a significant reduction in processing times, a drastic decrease in error rates, and an enhanced customer experience. In a landscape driven by digital innovation, the SAM widget is more than just a technological solution; it’s a strategic asset that empowers dealers to navigate the complexities of digital transformation with confidence and success.

As the industry continues to evolve, the SAM widget by DecisioningIT is not just keeping pace but setting the pace, offering dealers a robust, intuitive, and future-ready solution to thrive in the digital age.