As household debt in the U.S. continues to soar, the auto finance industry faces growing risks — and growing opportunities — in how it navigates consumer credit challenges. According to Experian, auto loan balances alone ballooned from $1.1 trillion in 2018 to nearly $1.5 trillion by the end of 2024. Combined with over $1.1 trillion in credit card debt, $251 billion in personal loans, and $1.6 trillion in student loans, American consumers are carrying an unprecedented debt burden.

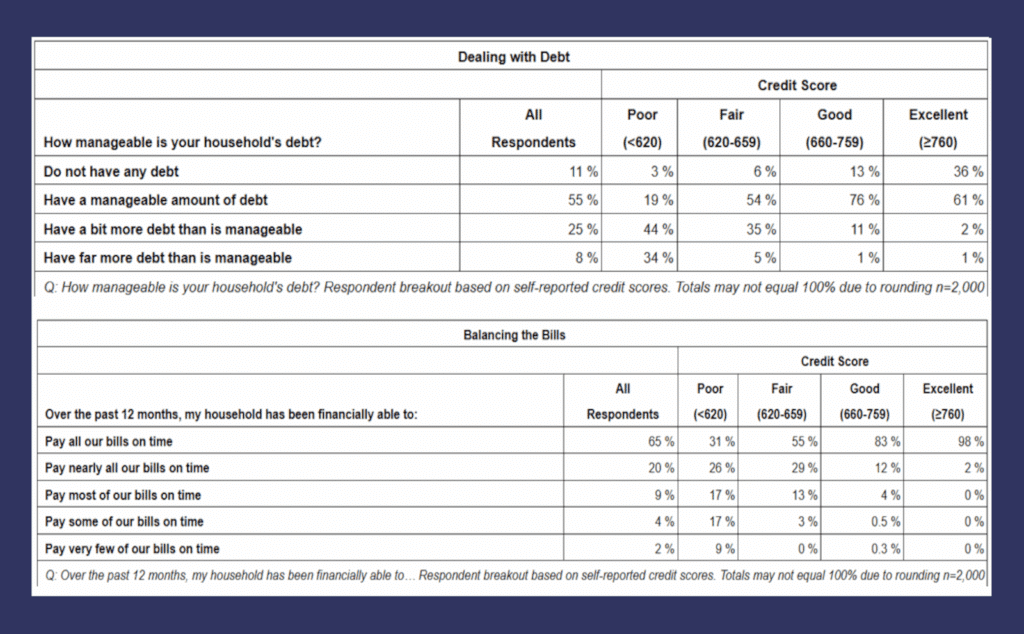

And it’s showing: 35% of consumers can’t pay all their bills on time, while 33% struggle to manage their debts overall.

In such a complex and strained environment, auto finance lenders can no longer afford to rely on outdated systems or gut-driven decision-making. At DecisioningIT, we believe this is the moment to embrace smarter, AI-powered solutions that can help you navigate credit risk, optimize approvals, and protect your bottom line.

The Debt Crisis: A Ticking Clock for Auto Lenders

The financial pressure on households is mounting fast. Achieve’s latest consumer survey reveals that:

- 26% of consumers increased their overall debt in Q4 2024.

- 57% carry credit card balances just to cover essential living costs.

- Only 31% of consumers with poor credit scores pay their bills on time.

These statistics aren’t just concerning for policymakers — they’re a flashing warning sign for lenders. Rising delinquencies, especially in auto loans, are already surpassing pre-pandemic levels, particularly among subprime borrowers. As Federal Reserve Governor Adriana Kugler noted, excess pandemic savings have dried up, and tighter monetary policy is now hitting home.

For auto finance providers, this means two things:

- Risk is increasing, especially in subprime markets.

- Opportunities lie in better risk assessment and faster, smarter approvals.

Smarter Risk Assessment with DecisioningIT

Legacy systems simply can’t keep up with today’s debt-laden consumer landscape. Many lenders are flying blind, using outdated credit models or slow manual processes that increase the risk of approving high-risk borrowers — or worse, rejecting viable ones.

DecisioningIT changes the game.

Our AI-powered decisioning engine, SAM, helps lenders make nuanced, data-driven credit decisions in real time. By integrating with multiple credit bureaus and analyzing a broader set of financial behaviors, SAM gives you:

- Real-time risk scoring that adjusts to current market conditions.

- Adaptive underwriting models that factor in changing consumer behavior.

- Automated approvals that reduce processing time and lower operational costs.

With SAM, you can confidently approve more loans while minimizing delinquency risks — a crucial advantage in a volatile economic climate.

Navigating Tight Credit Conditions: The Advantage of Automation

As consumers’ financial health deteriorates, time becomes even more critical. Manual loan processing slows down approvals, leading to lost deals, especially when buyers are under pressure to secure financing quickly.

DecisioningIT’s automation tools streamline the entire financing process, from credit evaluation to contract generation. With AI-driven workflows, you can:

- Approve more deals faster, especially during peak sales periods.

- Detect early warning signs of potential delinquency through predictive analytics.

- Customize financing offers in real time, based on accurate, up-to-date credit profiles.

This agility is essential as lenders need to pivot quickly in response to shifting economic conditions and consumer stress.

Supporting Responsible Lending: Helping Consumers Help Themselves

Financial literacy and debt management are top concerns among consumers today. As Brad Stroh from Achieve notes, “Financial literacy isn’t just about knowing what a budget is — it’s about having a plan in moments of stress.”

Lenders can play a vital role in supporting consumers — and protecting their own portfolios — by offering more transparent, fair, and flexible financing options.

DecisioningIT empowers you to:

- Tailor lending offers that are sustainable for consumers.

- Provide real-time feedback on credit applications, helping consumers understand their financial position.

- Develop stronger customer relationships through more intuitive, seamless financing experiences.

By aligning your lending practices with consumer realities, you not only build trust but also enhance long-term profitability.

Conclusion: It’s Time for Intelligent, Data-Driven Lending

The numbers are clear: debt levels are surging, delinquencies are rising, and consumers are under immense financial pressure. For auto finance organizations, the path forward is not through traditional, legacy systems that can’t handle today’s complexity.

It’s through smart, automated, AI-powered solutions like those from DecisioningIT.

Our technology is designed for this moment — helping you navigate tighter credit conditions, improve decision accuracy, and deliver a better experience for borrowers.

Let’s face the future of lending together.

Contact DecisioningIT today to learn how we can help you turn today’s debt challenges into tomorrow’s opportunities.