How fake tradelines are boosting credit of some borrowers

SAN DIEGO (Frank McKenna, Auto Remarketing June 2021) — Credit repair is a worthwhile endeavor for many consumers. And thankfully, there are thousands of companies that are there to help them by educating them on best practices or helping them to correct errors on their credit reports. These companies can even guide consumers through the credit improvement process.

But sometimes an unethical credit repair company can cross the line. A small number of credit repair companies will guide consumers down a slippery slope into questionable or even fraudulent activity and schemes.

One of the latest schemes to emerge might be the most challenging one to detect — fake tradelines. Those fake tradelines are being used to artificially inflate the credit scores of people that are using them so they can bypass lenders’ credit and fraud checks. For auto lenders this spells bad news since in many cases, they may be approving loans based on bad information and compromised credit scores.

Data furnishers report consumers accounts to credit bureaus

There are three credit bureaus that provide reports to third parties about the creditworthiness of consumers – Experian, Equifax and TransUnion.

Those bureaus gather information used to generate credit reports from many sources, including “furnishers.” Furnishers include entities that provide consumers with credit, such as credit card companies, mortgage lenders, automobile lenders and department stores.

Each time a consumer opens a new account, that account and all the subsequent activity is reported each month by furnishers to the credit bureaus in what are called “tradelines.”

Recently, suspicious tradelines have begun to appear

The credit reporting system works because the credit bureaus have trusted relationships with the data furnishers and rely on them to report accurate information. And for the most part, it works.

But lately, some suspicious tradelines have begun to appear. Fraud analysts and investigators were the first to notice the scheme. While they were investigating suspicious applications that looked like synthetic identities, they began to notice the same similar tradelines appearing over and over.

It was unusual, because the tradelines were not for your typical big banks, but obscure fi nance companies that they had never seen before.

And when investigators called the applicants and inquired about the tradelines, the applicants would advise them they had no recollection of what the tradelines were for. They only recalled having recently worked with a credit repair company who was helping them boost their credit scores in order to get loans.

Suspicious tradelines share common characteristics

The tradelines and credit bureaus of these accounts all share the same common characteristics.

- Th e tradelines were coming from obscure companies. The tradeline names didn’t seem to be companies they had ever seen before. They were all small finance companies.

- The tradelines had large limits, indicating that the borrowers were granted a big line of credit from this company.

- The outstanding balance was low, indicating that the loans were paid down. In some cases, the balance was zero, indicating that the loan was completely paid off.

- The payment history was perfect, indicating the consumer always paid on time.

- Th e credit bureaus appeared to be credit washed, synthetic bureaus or thin files. The suspicious tradelines only appeared when the consumer’s credit bureau appeared to be synthetic or credit washed. The files were very thin, which made these suspicious tradelines stick out even more.

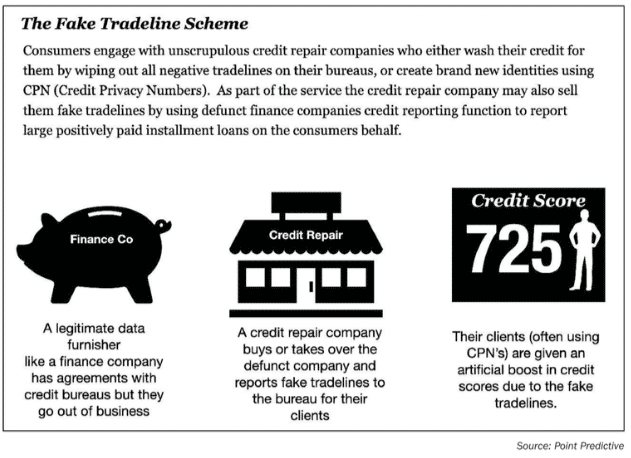

Investigators speculate that shell companies were being purchased to pass off fake tradelines

Some investigators began to speculate many of these suspicious tradelines were originating from defunct companies that had gone out of business. The speculation seemed warranted because after searching for information the companies, many appeared to be inactive or dormant companies that had seemingly sprung back to life this year.

These companies had possibly been granted data furnishing privileges with the credit bureaus before they went out of business.

Sensing an opportunity, credit repair companies may have rushed in to snatch these companies, buying them, or taking them over for the data furnishing privileges. Using that capability, they could start to send in fake tradeline data for their credit repair clients and boost their scores dramatically.

This is not the first time fake tradelines have emerged

While this scheme might be new, the fraud is not. You only have to go back to 2011 when the DOJ pressed charges against a fraud ring operating out of New York that made $1 million off selling fake tradelines to people with bad credit.

The fraud ring created two companies (Highway Furniture and New York Funding) with the intent to add fake tradelines to their clients’ accounts.

After creating the companies, they proceeded to add nearly 3,000 fake lines of credit to the credit history of hundreds of purported customers of New York Funding and Highway Furniture. In addition to adding the fake tradelines, they engaged in fraudulent credit washing – wiping out all of the negative tradelines of customers and keeping only the fake ones.

After having their credit fraudulently improved, the purported customers obtained more than $47.8 million in loans, including mortgages, car loans, student loans, and credit card loans.

More than $9.3 million in losses were sustained by the lenders who extended credit to the customers, who could not repay the loans.

Take action to prevent fake tradelines from impacting you

There are some obvious red flags that lenders and banks should be on the lookout for.

1. Look for suspicious thin files

When reviewing a credit bureau report, look for some of the obvious red flags where this fraud can occur. They are typically thin files consumers over 30 years of age.

Investigators will notice a conspicuous lack of credit or large gaps in credit granting for the consumer, and the only tradelines that will appear are very old tradelines granted before the credit profile was even created.

2. Look for identity anomalies with the borrower’s Social Security Number

Social Security Numbers will often be associated with multiple identities, randomized or hit bureau alerts for suspicious patterns. These often indicate use of CPNs.

3. Look for suspect tradelines

Suspicious tradelines will be obscure companies. They will most typically be for installment accounts with very high limits but low balances. This is on purpose, designed for maximum credit score boosting since paying down high balances is a sign on good credit worthiness.

4. Flag suspicious tradelines automatically

Establish a negative file of suspicious tradelines based on known fake tradelines. Parse out tradeline names from the credit report and route applications when the tradeline name matches to the known or suspicious fake tradeline database.

5. Spot borrower patterns during verification calls

Verify tradelines over the phone with applicants and borrowers. A suspicious pattern is likely, and the tradeline could be fake, if they are unable to tell you anything about the suspicious tradeline. Some applicants might even tell you that they are employed by the credit repair company itself.

6. Look for other signals of possible credit repair activity

Borrowers engaged in credit washing with credit repair companies will often exhibit a wide variety of similar features. Incomes will often appear to be inflated, and they will often use fictitious employers provided to them by the credit repair companies.

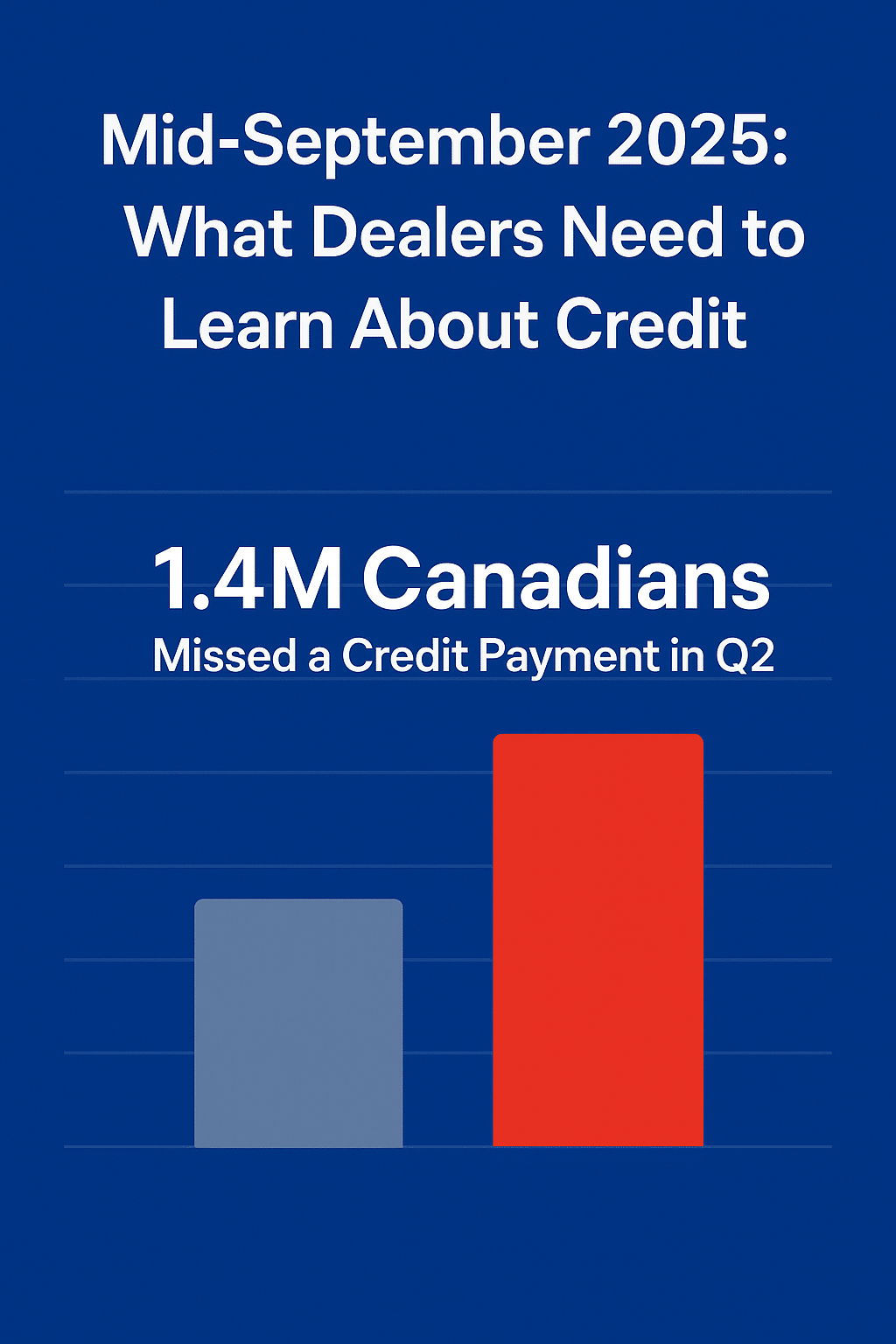

Be aware that fraud risk is everchanging

While fake tradelines seems to be the latest emerging scheme designed to fool auto lenders, it’s hardly the largest issue they face. In this post-pandemic environment, fraud risk is morphing and changing on a monthly basis.

My advice to lenders? Stay vigilant. Tomorrow there will likely be a whole new fraud to deal with!

Frank McKenna is the chief fraud strategist at Point Predictive.