The auto lending landscape is undergoing a radical transformation. Artificial intelligence (AI) is no longer just a buzzword; it’s a force reshaping how lenders operate, how decisions are made, and how customers engage with financing. From improving credit assessments to enhancing fraud detection and personalizing the borrower experience, AI is carving out its role as an indispensable tool in the modern lender’s arsenal.

But as powerful as AI is, its implementation demands responsibility, transparency, and a human-in-the-loop approach. At DecisioningIT, we believe the future lies not in simply adopting AI, but in adopting it right. Let’s explore how and why.

AI’s Fourfold Impact on Auto Lending

1. Better Credit Decisions, Faster

AI-powered credit decisioning engines enable lenders to evaluate vast datasets in seconds, revealing a deeper understanding of borrower profiles. Gone are the days of relying solely on FICO scores or static models. Today’s intelligent decisioning platforms—like those developed by DecisioningIT—help lenders incorporate alternative data, behavioral patterns, and contextual insights, leading to smarter approvals and fewer defaults.

🟢 How DecisioningIT helps: Our platform leverages real-time data and adaptive scoring to improve credit evaluations, ensuring that both prime and near-prime borrowers get fair access while minimizing risk for lenders.

2. Increased Operational Efficiency

AI automates repetitive, time-consuming tasks like document verification, data entry, and workflow management. This reduces the burden on loan officers and underwriters, allowing them to focus on high-value tasks such as customer relationship building and exception handling.

🟢 How DecisioningIT helps: With our automation features, dealers and lenders can dramatically cut down processing time, ensuring deals are funded faster and customers are engaged at just the right moment.

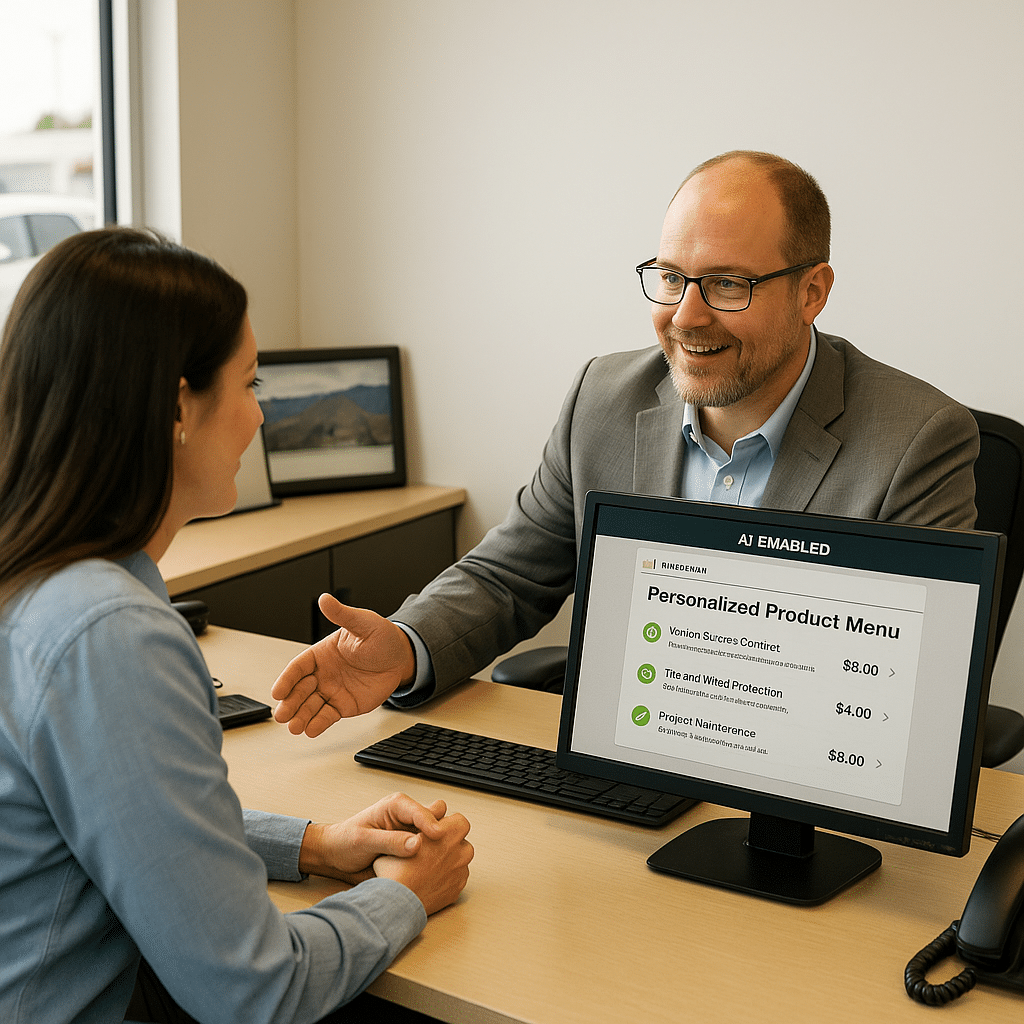

3. Personalized Customer Experiences

From personalized loan recommendations to dynamic messaging, AI enables one-to-one engagement at scale. Lenders can proactively tailor offerings based on borrower behavior, preferences, and historical data—delivering exactly what the customer needs, when they need it.

🟢 How DecisioningIT helps: Our adaptive interface dynamically adjusts recommendations based on buyer persona, credit tier, and purchase history, helping F&I teams maximize penetration and satisfaction.

4. Fraud Prevention

AI’s ability to detect anomalies in real time is crucial for combating fraud. By flagging inconsistencies or suspicious patterns, lenders can take immediate action, reducing exposure to losses.

🟢 How DecisioningIT helps: We integrate fraud prevention into the decisioning layer itself, reducing friction while keeping compliance and safety top of mind.

AI Done Right: Ethical, Explainable, Auditable

While the technical benefits of AI are clear, implementing it responsibly is critical. AI must be explainable to earn trust. Decisions must be auditable to reduce bias. Privacy must be protected through security by design.

🟢 How DecisioningIT helps: Our platform adheres to strict compliance and audit protocols. We ensure every recommendation can be traced, explained, and reviewed—putting humans in control of every high-stakes outcome.

What Dealers and Lenders Should Prioritize

Before adopting AI, assess where it adds the most value. Build a strategy that goes beyond the tech—one that includes ethical safeguards, staff education, and expert guidance.

🟢 How DecisioningIT helps: We partner directly with dealers and lenders to evaluate readiness, train teams, and align AI adoption with operational realities. Our decisioning solutions are business-user friendly, with no data science degree required.

Human + AI = Better Outcomes

At its best, AI amplifies human judgment—not replaces it. With the right balance of automation and oversight, dealers and lenders can increase revenue, reduce risk, and build stronger customer relationships.

AI is no longer a competitive edge. It’s the new standard. And with DecisioningIT’s intelligent decisioning platform, your dealership or lending institution is equipped to lead—not just adapt—in this new AI-powered era.