When people think of automation, they think it will make life easier. It’s something that will make things quicker, reduce manual or dangerous processes, and let us spend time on something else.

But that’s really only part of the picture.

I discovered that myself, when I took the role of CEO and Co-founder of a fin-tech framework company that uses an AI loan-matching platform and customer credit management to help dealers better (and more quickly) match consumers with various financial institutions.

We all have certain pre-conceived notions of automation, artificial intelligence or machine learning, and the way the terms are used interchangeably doesn’t help much either.

In my regular column in Canadian auto dealer, I hope to help dealers better understand how these, let’s say, “automated tools” are being used in the Canadian dealership space.

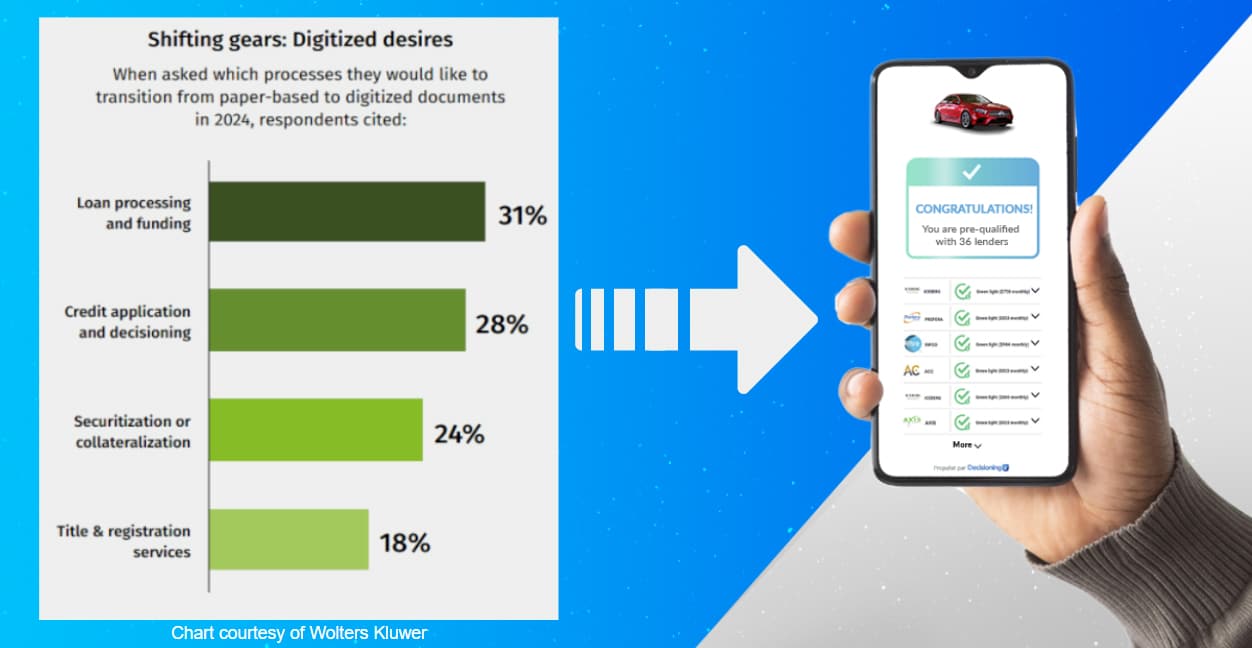

The applications are amazing, and the industry is ripe for even more new products to help transform what is still a pretty manual, and at times tedious experience for car shoppers and buyers, particularly when it comes to finance and insurance.

I come by that opinion honestly, as I’ve been working in the automotive industry for more than 15 years, with experience in sales and marketing and BDC, increasing and tracking ROI, and more.

Eighty-one per cent of finance or lease applications with a score below 675 are declined by dealerships. Those are lost deals from people we turn away from our stores.

My knowledge includes the Internet of Things (IoT) and working with companies focused on automotive tech, connected vehicles, and cyber security. But recently, I’ve really been focused on the challenges with the F&I operations in the store.

The good news is that these “automated tools” can help dealers close more leads, which is always something dealers like to hear.

I am enjoying this journey because it’s been great to show dealers how predictive AI technology can help them. Our tech was developed initially from within a dealership because our team had its own issues getting approvals.

Eighty-one per cent of finance or lease applications with a score below 675 are declined by dealerships. Those are lost deals from people we turn away from our stores— and the vehicles they want and need!

Most declines are due to a lack of experience and understanding of the non-prime space by the F&I manager. But predictive AI technology can help them match customers with various financial institutions, offer consumers a more transparent and seamless process, and reduce the F&I manager’s time spent on certain tasks.

Imagine your F&I manager going through lender criteria and all the updates they have on hand. It’s a lot of work and it can be time-consuming. But if that process is automated with AI that does machine learning, the machine is able to reduce that time and can hold onto a lot more data than a human being—or in this case, the F&I manager.

If one human being sees a thousand customers in their lifetime—and we’re talking about thousands of scenarios, thousands of ways to make that credit application work, where an actual human being may not be so focused on seeing the connections—AI can learn and automate tasks and processes, and open up possibilities and opportunities for dealers to better service their customers.

New technology that uses AI and machine learning can act like an assistant. So rather than spending an hour or two a week or more trying to figure out how to work a deal, you have a virtual assistant that’s going to give you all that information and make your job so much easier.

This type of automation is a lot about precision. It’s not taking that shotgun approach, but being more of a sniper, knowing exactly what you need to do to finish a client’s credit file. So when it comes down to it, especially on the finance side, it’s a very tricky, sensitive, dance you have to do, which is why the technology is so promising, and for so many areas of a dealership’s operations.

Automated tools, and machine learning algorithms that get smarter and smarter are all part of a big shift that auto retail is experiencing.

In future columns I will cover a broad range of topics ranging from decoding prime, sub-prime and deep-prime, to understanding the world of lenders, e-signatures and compliance, bank decisions, their approval process, machine learning, tech stacks versus portals, and so much more.

The challenges may be wide ranging, but the opportunities for AI and machine learning are seemingly endless.