ATLANTA – Autoremarketing.com

Well, perhaps auto financing is starting to look more like it did before the pandemic wreaked havoc on so much of our daily lives.

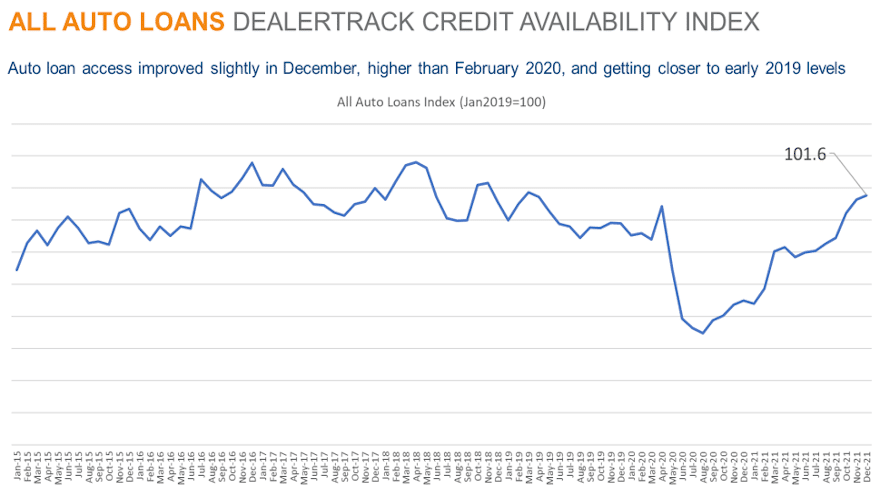

Cox Automotive said that access to auto credit expanded slightly in December, based on the Dealertrack Auto Credit Availability Index for all types of financing.

Analysts indicated the index increased 0.3% to 101.6 in December, reflecting that auto credit was easier to get in the month compared to November.

Cox Automotive said access was looser by 6.9% year-over-year, and compared to February 2020, access was more available by 2.4%. The last time the index was this high was April 2019

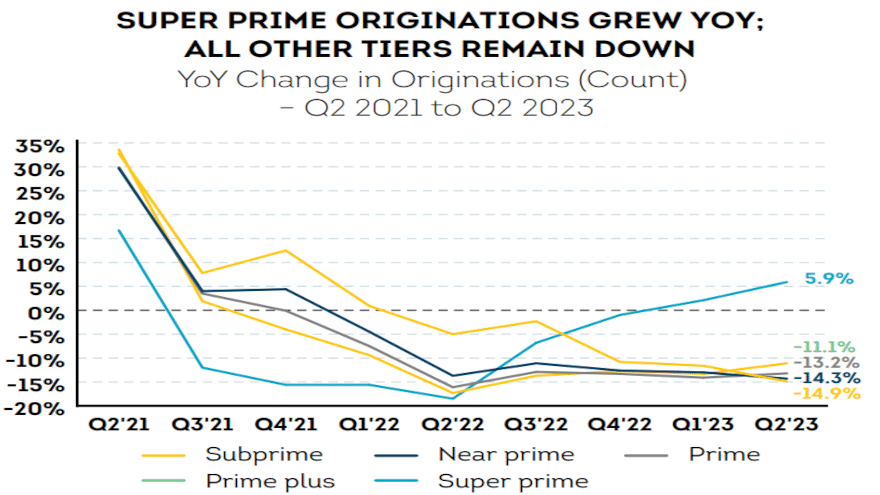

Analysts acknowledged not all types of financing saw easing in December.

Financing for used vehicles delivered at franchised stores and financing for certified pre-owned vehicles tightened, according to Cox Automotive’s report. Meanwhile, financing for used vehicles at independent dealers and contracts booked by non-captive institutions for new vehicles loosened the most

“Credit trends were also varied by lender type in December,” Cox Automotive said. “Banks tightened while auto-focused finance companies and captives loosened, and credit unions were unchanged. On a year-over-year basis, all lenders had looser standards with captives having loosened the most.”

Analysts reiterated that each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in December, yield spreads narrowed, terms lengthened, down payments declined and the approval rate increased, and the moves in those factors made credit more accessible,” Cox Automotive said.

“However, the subprime share declined, and the negative equity share declined, and the moves in those factors made credit less accessible,” analysts added.

Cox Automotive wrapped up its latest update by touching on the state of people taking on that auto financing, noting that December generated mixed trends associated with consumer sentiment.

Analysts pointed out that consumer confidence according to the Conference Board increased 3.5% in December, and the November reading was revised higher.

“However, in the underlying components, the view of present situation declined slightly while the view of the future jumped 7.4%,” Cox Automotive said.

Continue reading here: https://www.autoremarketing.com/subprime/auto-financing-availability-ticks-slightly-higher-finish-2021