BURNABY, British Columbia – (AutoRemarketing) Just like customers test-drive numerous cars before finding the best deal for the perfect make, model, features, and color, automotive dealers need to be discerning about their technology partners.

The loan origination process is a perfect example. Typically mired by cumbersome, labor-intensive processes, new software has taken the pain and expense out of manual loan origination. It is now by all accounts faster, cheaper, and easier to move from Point A to Point B when processing loans.

Decisions are made faster, and errors — which were once commonplace — are now few and far between. Loan origination software matters, and ideally, it should support all aspects of loan processing workflows. But like many other services, not all software is created equal.

Dealers face extreme competition, particularly since customers can easily comparison-shop online for both vehicles and loans. Savvy dealers are recognizing that the most innovative LOS portals can achieve much more than originating loans. Many are learning that advanced online solutions enable dealers to differentiate themselves by delivering an elevated customer experience that transcends just lending.

By keeping the entire customer interaction in-brand, in a reliable and comfortable environment, the dealer has the unique opportunity to strengthen its relationship with its customers, and offer value-added services like service contracts — or even other financing products like credit cards — throughout the application process.

Offering financing is an integral part of an auto dealer’s business, but it’s also an essential step in providing a positive customer journey.

A superior “dealer-controlled” LOS experience

Today, more dealers are opting to provide customer financing on their own rather than referring buyers to a third-party lender. This keeps as much of the loan origination process in-house, allowing dealers to control the customer experience. The management of loan origination workflows should be a straightforward process.

Automated tools should pull credit reports, score the applicant’s credit, auto-approve or auto-deny the application, initiate an approval or denial letter, populate the loan documents, and issue reports to both internal and external databases, such as CRM platforms, credit reporting agencies and other bodies.

Customizability is also an important attribute of a quality LOS system. Every dealer has their own unique requirements for processing loans. Many LOS systems offer little in the way of flexibility or customizability to accommodate specialized requirements.

In these instances, the dealer or lender must radically change their workflows to accommodate the LOS system, which can be an arduous and error-filled process.

Automotive dealers should seek out LOS providers that can offer a more flexible and scalable system that can be molded to meet the ever-changing demands of the marketplace. Locking into a fixed solution will only cause pain, disruption, and expense down the road—all of which can be avoided with the right partners, and a best-in-class platform.

The right LOS technology partner should provide all these capabilities — as well as complementary loan servicing systems — to take the burden and expense out of lending. However, the ideal loan origination platform can add so much more value to the dealer — and to the customer.

It can also create efficiencies for the dealership, and provide opportunities to create a superior and customized buying experience.

Beyond loan origination

To be a truly effective partner, a financial technology provider should deliver more than just loan processing capabilities. More comprehensive platforms can offer complementary services such as collections, payment processing, and basic customer service features. Automating these activities streamlines workflows, increases efficiency, and saves the dealership time and money.

Advanced LOS systems can also be utilized as revenue-generation tools, which can entirely change the nature of the dealer-customer engagement. Consider that applicants within the LOS portal have already made an emotional investment in the brand, and are now strong candidates for a bevy of complementary products and services than what is traditionally offered through the LOS.

Whether it’s high-margin extended warranty plans, infotainment packages — or even adjacent financial products like credit cards — applicants are more receptive to ancillary offers within the LOS than those who must deal with the laborious tasks of completing a loan application.

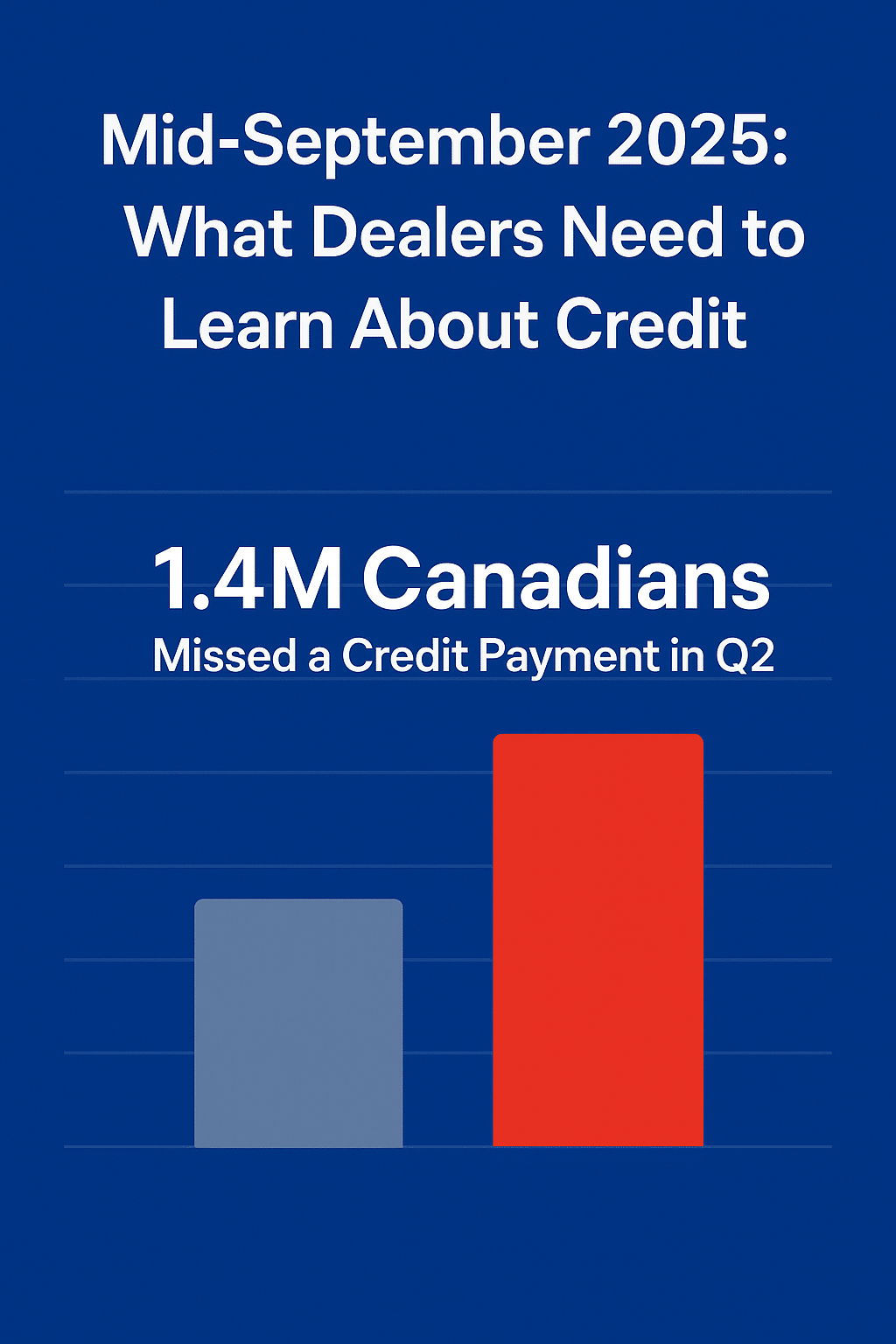

The dealer can also use the analytics from the LOS to refine its offers to match the needs of the buyer. For example, if the applicant has comparatively high credit card debt, refinancing offers can be seamlessly delivered to that customer.

A customizable platform can cater to any promotions, incentives, or specialized programs the dealer can dream up. It allows the dealership to cater to trends as they arise, and become more agile in promotion and cross-marketing. The right LOS platform can become an indispensable tool for top line needs, as well as for loan processing.

A loan origination platform should not just provide an infrastructure to score, decision and process loan applications, but should empower dealers to create a better digital experience that can translate into sales, customer satisfaction, and greater profitability. The right LOS solution enables the dealer to achieve these business imperatives, and pull ahead of its competition.