The auto finance industry is currently navigating a challenging landscape, marked by tightening credit conditions. These conditions are not only affecting consumers but also finance companies themselves. This blog post delves into the current credit environment, the challenges faced by finance companies, and the potential strategies to mitigate these difficulties.

The Current Credit Environment

The auto finance industry is experiencing a period of stringent credit conditions. Several factors contribute to this scenario:

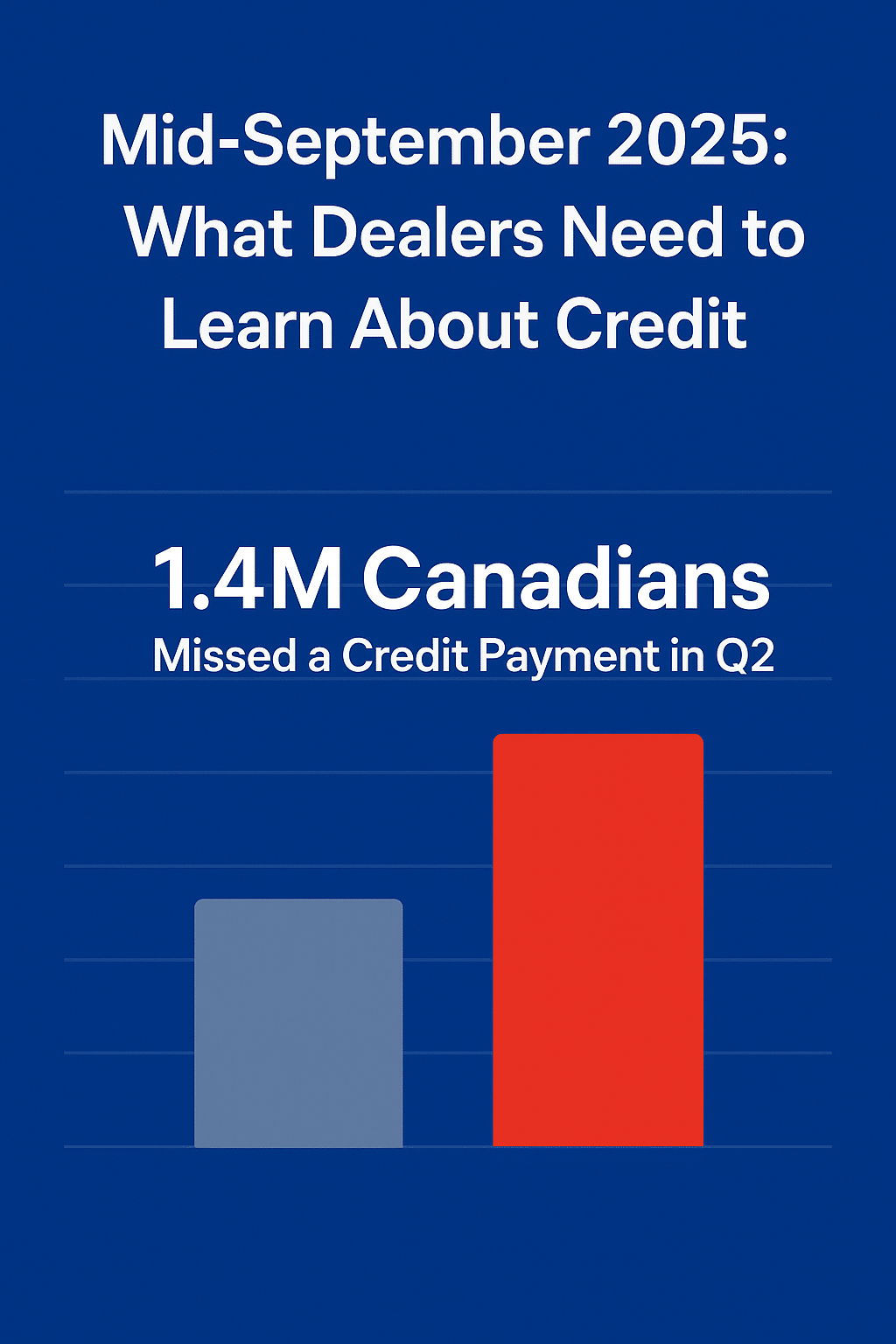

- Economic Uncertainty: Ongoing economic uncertainties, including inflation and fluctuating interest rates, have led to a more cautious approach from lenders.

- Rising Delinquencies: There has been an increase in loan delinquencies, prompting lenders to tighten their credit criteria to mitigate risks.

- Market Volatility: Volatility in the financial markets has also influenced the credit environment, making it more challenging for finance companies to secure funding.

Challenges for Finance Companies

Finance companies are facing several hurdles as a result of these tough credit conditions:

- Increased Scrutiny: Lenders are under increased scrutiny from regulatory bodies, requiring stricter adherence to lending standards and practices.

- Higher Borrowing Costs: The cost of borrowing for finance companies has risen, affecting their profitability and ability to offer competitive rates to consumers.

- Limited Access to Capital: Access to capital markets has become more restricted, limiting the ability of finance companies to raise funds for lending purposes.

Strategies to Navigate the Tough Conditions

Despite the challenges, finance companies can adopt several strategies to navigate the current credit environment:

- Enhanced Risk Management: Implementing robust risk management practices can help finance companies better assess and mitigate potential risks.

- Diversification: Diversifying the portfolio of lending products can reduce dependency on a single market segment and spread risk more effectively.

- Technology Integration: Leveraging technology to streamline operations, enhance credit assessment processes, and improve customer service can provide a competitive edge.

- Strategic Partnerships: Forming strategic partnerships with other financial institutions can enhance access to capital and share the burden of regulatory compliance.

The auto finance industry is currently facing tough credit conditions that pose significant challenges to finance companies. However, by adopting strategic measures such as enhanced risk management, diversification, technology integration, and strategic partnerships, finance companies can navigate this challenging landscape and continue to support the automotive market effectively.