In the dynamic landscape of car buying, speed and convenience are becoming increasingly vital. CDK Global’s recent survey provides revealing insights into the intricacies of modern-day car purchasing experiences, emphasizing the urgency of a more streamlined process. Enter SAM, the revolutionary widget by DecisioningIT, promising to address the identified pain points.

Delving Deeper into CDK Global’s Insights

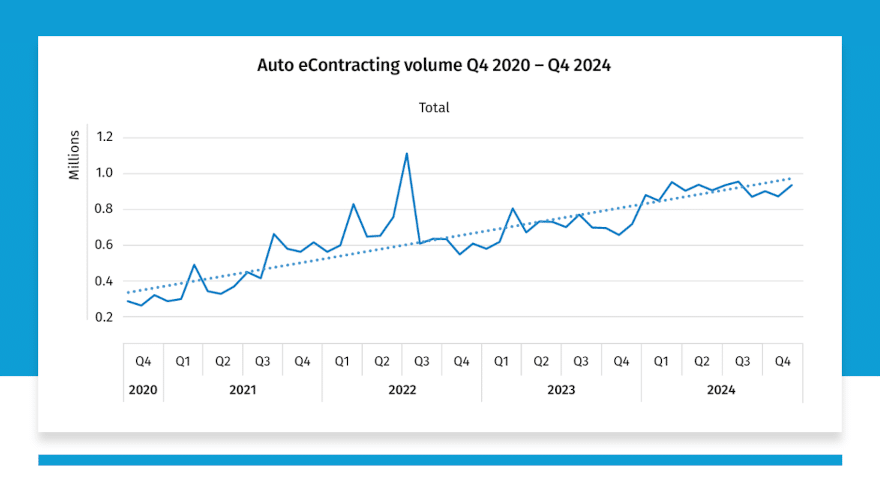

The Ease of Purchase Scorecard by CDK Global sheds light on a rather curious paradox. A substantial 83% of consumers believed that purchasing a car was a straightforward task. However, this perceived ease takes a sharp turn, with satisfaction ratings diving from a commendable 71% to a mere 54% if the purchasing process spans more than three hours.

Initiated in June 2022, this monthly survey was designed to grant dealers a comprehensive understanding of consumer sentiments during car buying. Astonishingly, of the consumers surveyed, 77% expressed extreme contentment if the entire transaction was wrapped up in two hours or less. The study also indicated that the longer the transaction time, the less likely customers were to recommend the dealership to others.

Furthermore, the survey touched upon the undying allure of physical dealerships. Despite the growing trend and accessibility of online car shopping, a whopping 66% of respondents leaned towards traditional brick-and-mortar showrooms. Even in the digital age, a negligible 2% made their new car purchase entirely online.

David Thomas from CDK Global elaborated on this preference, “The direct-to-consumer retail model, though growing, hasn’t dampened the enthusiasm for in-person dealership experiences. This is especially evident among first-time buyers, with a staggering 70% relying on their local auto dealers to guide them throughout the purchasing journey.”

SAM: The Future of Car Financing

DecisioningIT, ever at the forefront of technological financial solutions, introduces SAM – a game-changing online finance widget designed to modernize the automotive lending industry. SAM utilizes cutting-edge decision-making algorithms to swiftly pair consumers with an array of lenders, irrespective of their credit history.

Historically, acquiring a loan has been a drawn-out, often daunting process, particularly for those with imperfect credit scores. SAM challenges and changes this status quo, offering an accelerated, user-centric lending experience.

Rosa Hoffmann, CEO of DecisioningIT, expressed, “SAM is our answer to traditional lending woes. It not only simplifies but also revolutionizes how consumers secure vehicle loans, ensuring all-inclusive, real-time financial solutions.”

Key features of SAM include:

- Rapid Matching: Borrowers are matched with potential lenders in mere seconds.

- Holistic Credit Evaluation: By analyzing diverse financial data points beyond credit scores, SAM ensures broader accessibility to suitable lending options.

- Robust Security Protocols: Employing advanced security measures, SAM guarantees absolute data privacy.

- Seamless User Interface: Intuitively designed, SAM promises an effortless loan application journey for users.

For dealerships, SAM isn’t just a tool; it’s an ally. Offering quick integrations and intuitive features, it’s poised to transform the very fabric of dealership financing, benefiting both consumers and staff.

Wrapping Up

While CDK Global’s survey astutely underscores the exigency for a quicker car sales process, solutions like SAM stand ready to meet the challenge. As dealerships aim to elevate their customer experience, blending the invaluable insights from such surveys with advanced solutions like SAM might just be their formula for long-lasting success and customer loyalty. For a deeper dive into how SAM can aid dealerships in this journey, we are just a call away.