TransUnion’s recent findings indicate a consistent downturn in the issuance of subprime auto loans, alongside a significant jump in delinquencies, as we move further into 2023.

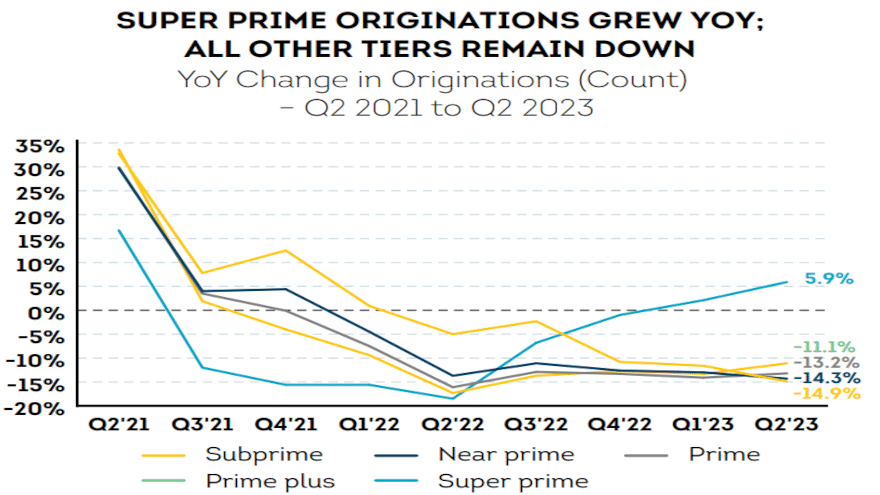

In the latest quarterly report, the trend of diminishing originations was observed across nearly all risk tiers. The second quarter of 2023 saw a 9% year-over-year decrease in auto finance originations, totaling 6.3 million, with a modest quarter-over-quarter increase of 4.6%. It’s worth noting that super prime originations were the exception, witnessing a 5.8% year-over-year increase.

Subprime and near-prime originations witnessed the most considerable reduction, dropping by 15.2% compared to last year. In a more pressing concern, delinquencies of 60 days or more escalated to 1.35% in the third quarter, up from 1.19% in the same quarter of the previous year, as per TransUnion’s analysis.

Interestingly, while early 2022 delinquency rates appeared significantly worse, preliminary data suggests a marginal improvement for the first quarter of 2023 originations compared to the same period last year.

The report also highlights a shift back towards pre-pandemic patterns in new versus used vehicle financing. New vehicles accounted for 43% of all financed units in Q3, a rise from 39% the previous year.

However, the figures for average amounts financed revealed a divergence, with new vehicle financing witnessing a 2.6% year-over-year reduction, and used vehicle financing decreasing by 4.8%. Monthly payments, conversely, are trending upwards, with a 1.3% increase for used cars and a more substantial 4.2% hike for new cars on a year-over-year basis.

As for leasing, the market share has risen to 21% of new vehicle registrations from a low of 17% in 2022, yet it remains beneath the pre-pandemic level of roughly 30%.

In light of these market shifts, innovative technologies like the SAM widget from DecisioningIT are emerging as key tools for dealerships. SAM enhances the efficiency of the loan origination process by instantly prequalifying applicants, which is increasingly vital as lenders navigate a market characterized by cautious underwriting and heightened attention to risk.

SAM’s real-time analytics assist dealers in identifying creditworthy consumers amidst a contracting subprime market. Its seamless integration into dealers’ existing platforms provides a frictionless experience for both dealers and consumers, potentially mitigating the impact of tightened lending standards.

With the industry grappling with the repercussions of high-interest rates and persistent inflation, SAM represents the next step in lending technology—enabling smarter, more secure lending decisions while improving the customer experience.

As the auto finance sector adjusts to these developments, the role of advanced tools like SAM is poised to become even more critical. Not only do they offer a means to refine operational efficiencies, but they also ensure lending decisions are aligned with the real-time financial landscape.