Key learnings from Equifax’s Q2 2021 Credit trends and economic insights.

Equifax recently posted their Q2 credit trends and their introduction went as follows: “Mortgage volumes are the highest they’ve ever been in a single quarter. Non-mortgage credit demand is also on the rise. These insights present growth opportunities to help you better understand your clients’ credit needs and can also help deepen your relationships.“

Total Consumer Debt Climbs Higher

Driven by considerable mortgage growth, overall consumer debt now stands at $2.15 trillion, up 3.0 per cent from last quarter and up 7.5 per cent from Q2 2020. On an individual basis the average consumer debt (excluding mortgages) is $20,640, a drop of 1.6 per cent when compared to Q2 2020, but an increase of 1.0 per cent versus Q1. Lower average debt is consistent with all risk segments except for consumers with higher credit scores. The average non-mortgage debt per consumer is up by 1.0 per cent from last year for this group, driven by increased demand for credit cards and loans.

Adding to the overall increase in consumer debt, volumes for new auto and installment loans are returning to pre-pandemic levels. When compared to the lows of Q2 2020, they show a 47.2 per cent (new auto) and 19.5 per cent (installment loan) increase in new volume this quarter.

New credit card growth is also picking up pace, doubling the volume seen a year ago when demand was at its lowest. Quarter over quarter new card volume increased by 2.8 per cent, but has yet to reach pre-pandemic levels. The average credit limit assigned to new cards is also increasing, up 4.4 per cent when compared to the same time period last year.

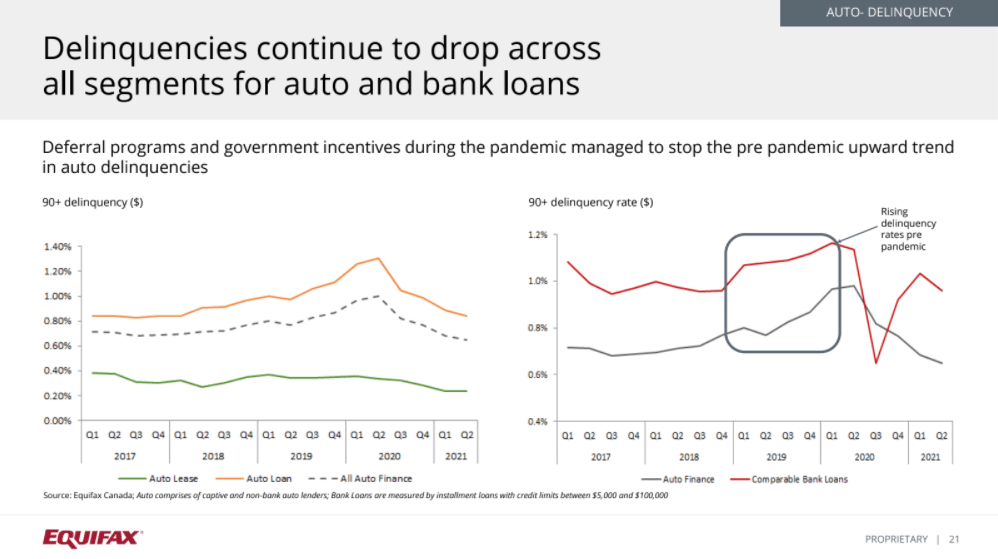

Delinquencies Continue to Decline

Despite deferral programs ending, delinquency rates dropped from Q1 2021. Government support and increased disposable income are still helping consumers pay off their debts and improve their credit score. The average Equifax credit score for consumers increased by 12 points in the last two years.

The 90+ day delinquency rates for both mortgage and non-mortgage products continued to decrease this quarter, down by 32.6 per cent and 28.6 per cent respectively, when compared to Q2 2020.

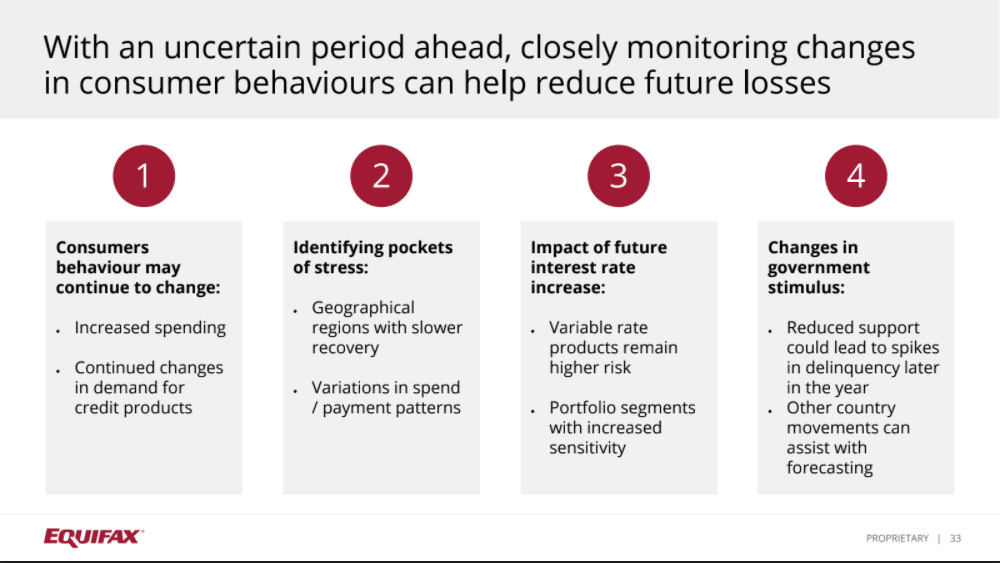

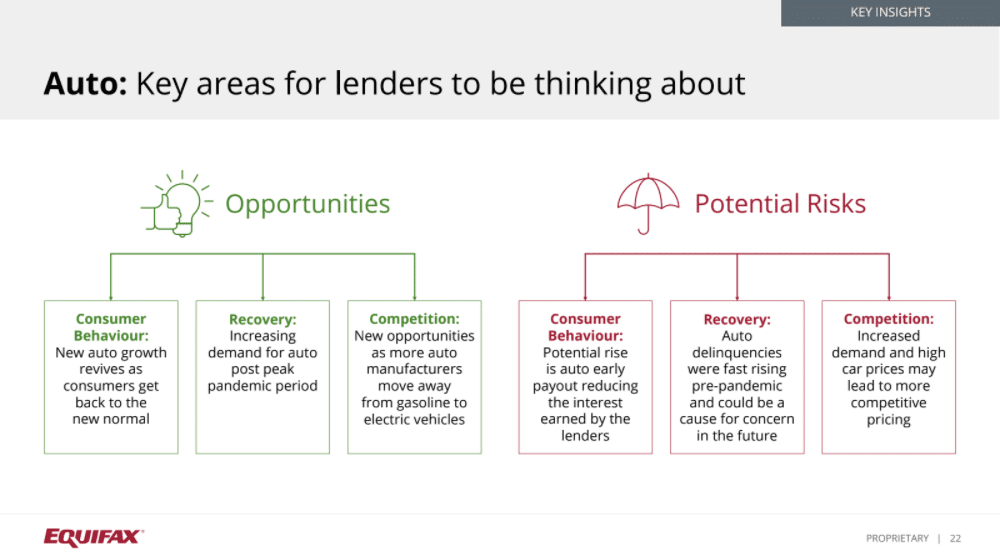

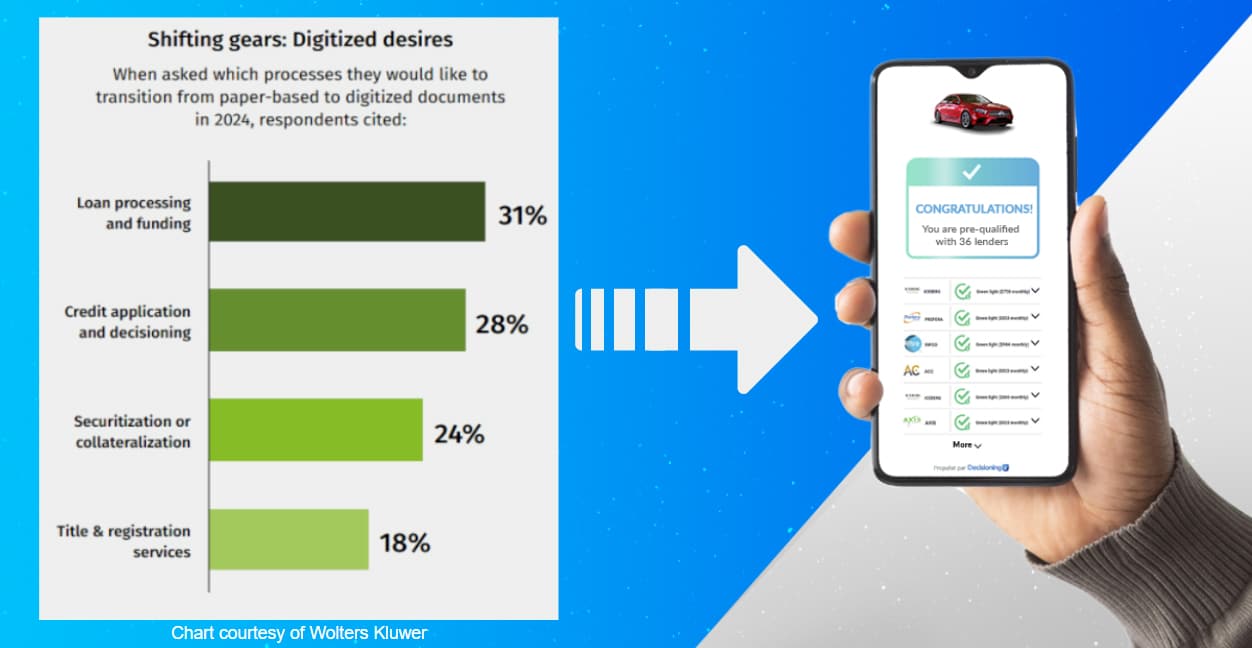

Automotive Trends

Here are 3 slides that got my attention, in Equifax’s Q2 2021 Credit trends and economic insights.