As financial landscapes evolve, so does the behavior of those who navigate them. A recent study by TransUnion, presented at the 2024 Financial Services Summit, delves into the credit usage patterns of Generation Z and compares them with the millennial generation at a similar age. This analysis offers a glimpse into the financial habits and challenges faced by the newest credit-active generation.

Early Financial Challenges and the Impact of Economic Shifts

The study, titled “Solving for Z,” identifies that both Gen Z and Millennials have faced significant financial hurdles early in their credit journeys. Approximately 75% of Gen Z respondents indicated their finances were adversely affected by the pandemic-induced recession. In contrast, about 60% of Millennials felt the impact of the global financial crisis during their formative years. This comparison not only highlights the cyclical nature of economic challenges but also emphasizes the varying external factors that influence financial health across different generations.

Increased Credit Utilization Among Gen Z

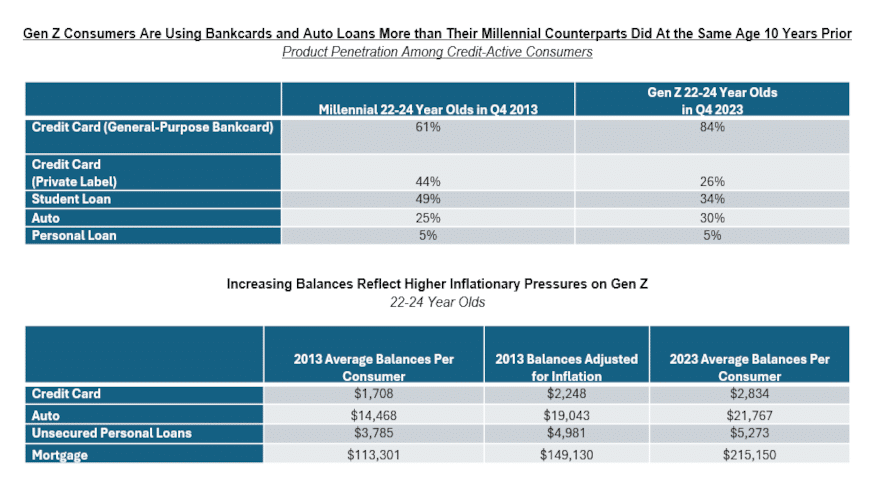

One of the standout findings from the study is the higher level of credit utilization among Gen Z consumers compared to their millennial counterparts. Notably, 84% of credit-active Gen Z individuals had at least one credit card by the end of 2023, a significant increase from the 61% of Millennials who had one at the same age. This rise is linked to the increased cost of living and higher inflation rates that have characterized recent years, pushing more consumers to rely on credit cards as a financial buffer.

Financial Products and Preferences

The survey also sheds light on the preferences of Gen Z in terms of credit products. A notable 36% of Gen Z consumers ranked credit cards as their most useful financial tool, up from 29% of Millennials. This shift suggests a strategic adaptation to the current economic climate, where credit cards play a crucial role in managing everyday expenses due to their accessibility and immediate liquidity.

Delinquency and Debt Management

Despite having access to more credit lines, Gen Z is also experiencing higher levels of debt and delinquency compared to the previous generation. This trend is reflective of the broader economic challenges that have persisted post-pandemic, such as elevated inflation and interest rates, which have strained the financial capabilities of younger consumers.

Looking Ahead: Credit Education and Management

The study highlights the importance of ongoing monitoring and education in managing credit effectively, especially for younger consumers who are at the beginning of their credit journeys. The findings suggest that establishing strong credit management practices early on can significantly impact financial stability and resilience against economic fluctuations.

In conclusion, as Gen Z navigates their unique financial challenges, their evolving credit usage patterns reflect both the impacts of recent economic downturns and their adaptive strategies. This generational snapshot not only informs financial service providers but also underscores the need for tailored financial education that addresses the specific needs and circumstances of emerging adults in today’s economy.

Source: https://www.autoremarketing.com/subprime/transunion-gen-z-using-credit-more-than-millennial-counterparts-at-same-ag