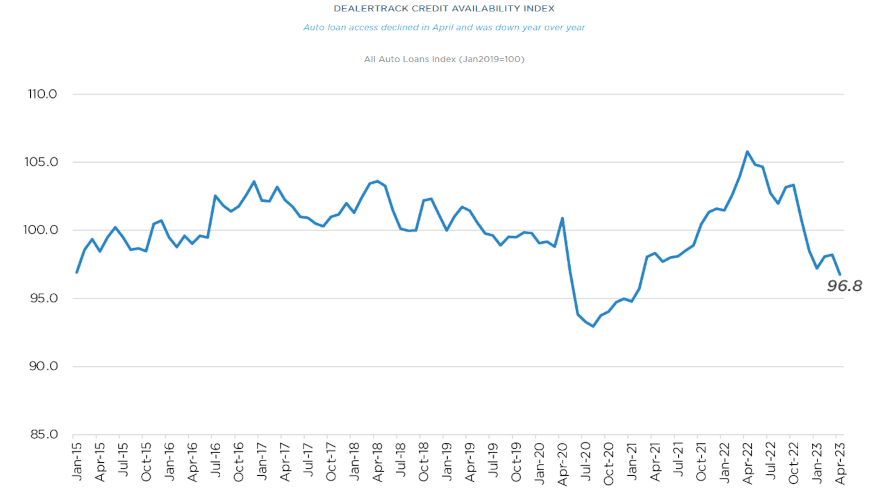

The newest Dealertrack Credit Availability Index has revealed that access to auto finance credit tightened in April to the lowest point in more than two years, largely due to three headwind factors having more impact than the trio of trends in the helpful category. Cox Automotive reported that credit access tightened across all channels and finance company types in April, with the index declining 1.5% to 96.8, the lowest reading since February 2021, indicating that auto credit was harder to get. Compared to February 2020, access to auto finance credit was tighter by 2.4%.

According to analysts, movement in credit availability factors was mixed in April. Yield spreads narrowed, average terms lengthened, and down payments declined, improving credit access for consumers. However, decreases in the approval rate, subprime share, and negative equity share hurt consumer credit access. Analysts noted that the average yield spread on auto financing booked in April narrowed by 20 basis points, making rates consumers received on their installment contracts more attractive. Cox Automotive also revealed that credit availability in April declined for both used and new vehicles. In March, analysts had reported tightening in the used market, but loosening in the new space.

Furthermore, Cox Automotive revealed that credit unions tightened the most, while auto-focused finance companies tightened the least when it comes to underwriting choices by provider category. The Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads, and contract details, including term length, negative equity, and down payments, with the index baselined to January 2019 to show how credit access shifts over time. With access to auto finance credit tightening, consumers may face difficulties in securing auto loans, while auto dealers may also experience lower sales.