Bias in auto financing arises when sales managers, business managers and even lenders makes sales or loan decisions based on perceptions rather than facts. Such decisions might stem from unconscious prejudices, such as a customer’s perceived reliability or their postal address. Sometimes, these biases can even influence a business manager to refuse a sale based on anticipated profit, especially if the client has alternative credit and might face restrictions on the amount they can secure in F&I products.

However, these biases aren’t just limited to the business manager’s desk. Salespeople at the dealership’s front door often make snap judgments too. Commonly observed behaviors include guiding a “non-prime” or alternative credit customer towards a specific, sometimes older, vehicle just to offload it. There’s the age-old assumption that a customer who walks in, poorly dressed, might not be a potential “prime” buyer. These prejudices might seem minor at the sales level, but they’re considerably more damaging when made by a business manager since loan decisions can impact a customer’s life conditions for an extended period – sometimes up to 8 years!

In the US, the Federal Reserve Bank of Chicago found substantial evidence of racial and ethnic discrimination in auto financing. Whether biases are based on personal characteristics or assumptions about creditworthiness, they’re detrimental to consumers and can also negatively impact dealers and lenders.

Adequate decision-making eliminates all forms of discriminatory considerations.

The Potential of AI in Promoting Equitable Decisions

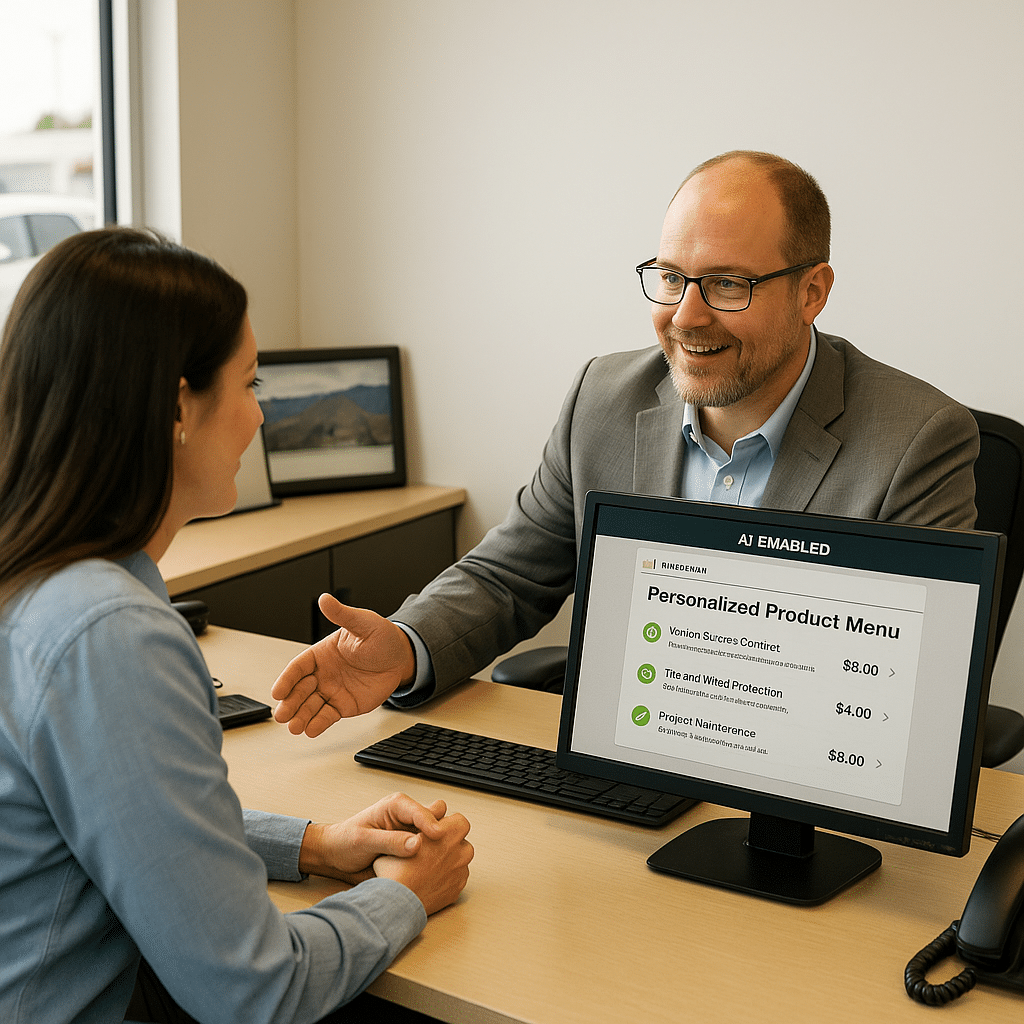

SAM, our cutting-edge Widget powered by artificial intelligence, acts as the cornerstone in the battle against biases within the auto finance sector. Through its objective and all-encompassing analysis, SAM ensures that every loan decision is based purely on factual data, eliminating room for subjective human biases. It comprehensively presents a spectrum of loan alternatives, assuring that clients obtain offers meticulously tailored for them.

Artificial intelligence paves the way to an expansive treasure trove of data, which transcends the confines of typical loan applications and credit score metrics. With the power of SAM (Credit application widget) at their fingertips, dealers witness a profound transformation in their sales and financing workflow, marking the dawn of a new age of clarity and operational excellence. The core strength of SAM lies in its algorithms’ prowess to diligently filter out historical biases, guaranteeing that every consumer finds their perfect match in both a vehicle and a lender. This process not only amplifies the odds of striking optimal deals for both parties but also propels the sales process at an unprecedented pace. Dealerships can now revel in the assurance of presenting unbeatable terms to their customers. In contrast, buyers are treated to a smooth, unbiased journey. The upshot? An environment where dealers enjoy swift, lucrative transactions and consumers leave with the assurance of having secured a just and customized deal. SAM’s revolutionary methodology promises a streamlined, user-focused financing journey, setting new standards in the realm of auto financing.