Cox Automotive recently released a report stating that credit availability for auto finance has reached a two-year low. The April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices, conducted by the Federal Reserve, further indicated that this trend may persist in the foreseeable future.

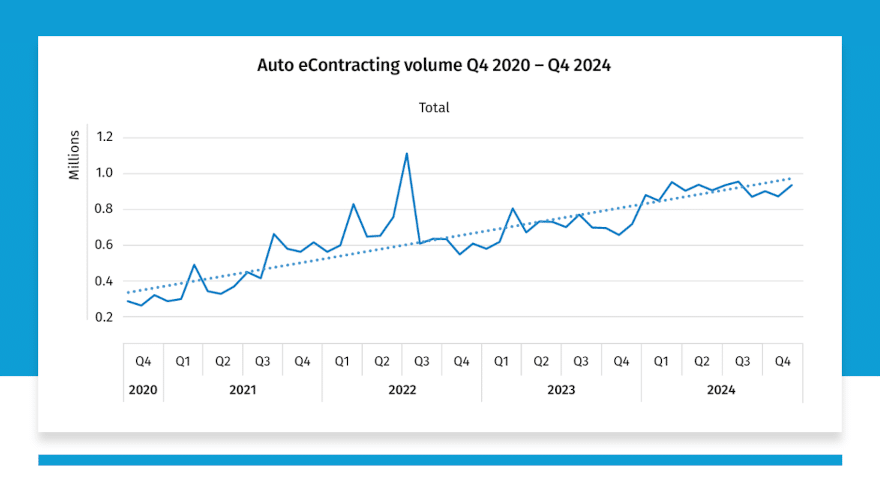

According to the Dealertrack Credit Availability Index, access to auto credit tightened again in May. Cox Automotive revealed that the index dropped by 0.4% to 96.4, marking the lowest reading since February 2021. This decline reflects the fact that obtaining auto credit in May was more challenging than in any month since the second quarter of 2021.

Compared to the previous year, experts reported that access to auto credit had tightened by 8.0% in May. Furthermore, compared to February 2020, access was tighter by 2.8%, according to Cox Automotive’s analysis.

Cox Automotive’s analysis of the latest index reading highlighted mixed movements in credit availability factors in May. While yield spreads narrowed, average terms lengthened, and down payments declined, which improved credit access for consumers, the decline in the subprime share and negative equity share negatively impacted credit access for consumers.

The Federal Reserve’s survey of banking executives included a question about their expectations for lending standards for auto loans in the remainder of 2023. Out of the 46 participants, 28 responded that their bank’s lending standards would remain basically unchanged, while 17 executives expected them to tighten somewhat.

The survey analysis by the Federal Reserve revealed that banks had tightened various terms on auto loans and other consumer loans. Specifically, a significant number of banks reported wider interest rate spreads on auto loans, while moderate numbers reported raising minimum repayments, minimum credit scores, and decreasing the extent to which loans are granted to customers who do not meet credit scoring thresholds, as well as decreasing maximum maturity.

Cox Automotive also noted that the average yield spread on auto financing in May narrowed by 10 basis points, making the rates more attractive for consumers relative to bond yields. In May, the average auto finance rate decreased by 4 basis points compared to April, while the five-year U.S. Treasury increased by 6 basis points, resulting in a narrower average observed yield spread.

While the approval rate remained unchanged in May, it softened by 2.4 percentage points year-over-year. Cox Automotive reported a decline in the subprime share from 11.7% in April to 11.0% in May, along with a 1.2 percentage point decrease year-over-year.

Additionally, Cox Automotive observed a 0.6 percentage point increase in contracts with terms longer than 72 months in May, but a slight 0.2 percentage point decrease year-over-year.

The Dealertrack Auto Credit Index tracks changes in approval rates, subprime share, yield spreads, and contract details such as term length, negative equity, and down payments. It is based on January 2019 data and provides insights into shifts in credit access over time.

The Federal Reserve plans to conduct its next survey of banking executives in July, which will likely provide further information on the state of auto lending standards and credit availability.