JOHN HUETTER – Reporter covering the finance-and-insurance business and auto retailing for Automotive News

Performing a soft pull on a customer’s credit at the start of the buying process can improve sales and reduce awkward conversations in the F&I office, according to 700Credit.

“You’re removing that friction,” 700Credit Managing Director Ken Hill told a webinar Tuesday.

A traditional “hard pull” formal credit check appears on a credit report and affects one’s score, according to Hill. But a “soft pull” doesn’t, and its existence is visible only to the borrower.

Bob Lettis, 700Credit senior vice president of business development, said last month dealerships have reported 5 to 15 percent increases in sales by adopting soft pulls. Automakers have grown interested in the concept as well.

The government has permitted soft pulls since 2009, according to Lettis. They’re now available for all three credit bureaus and allow a customer the ability to shop around for a deal, he said.

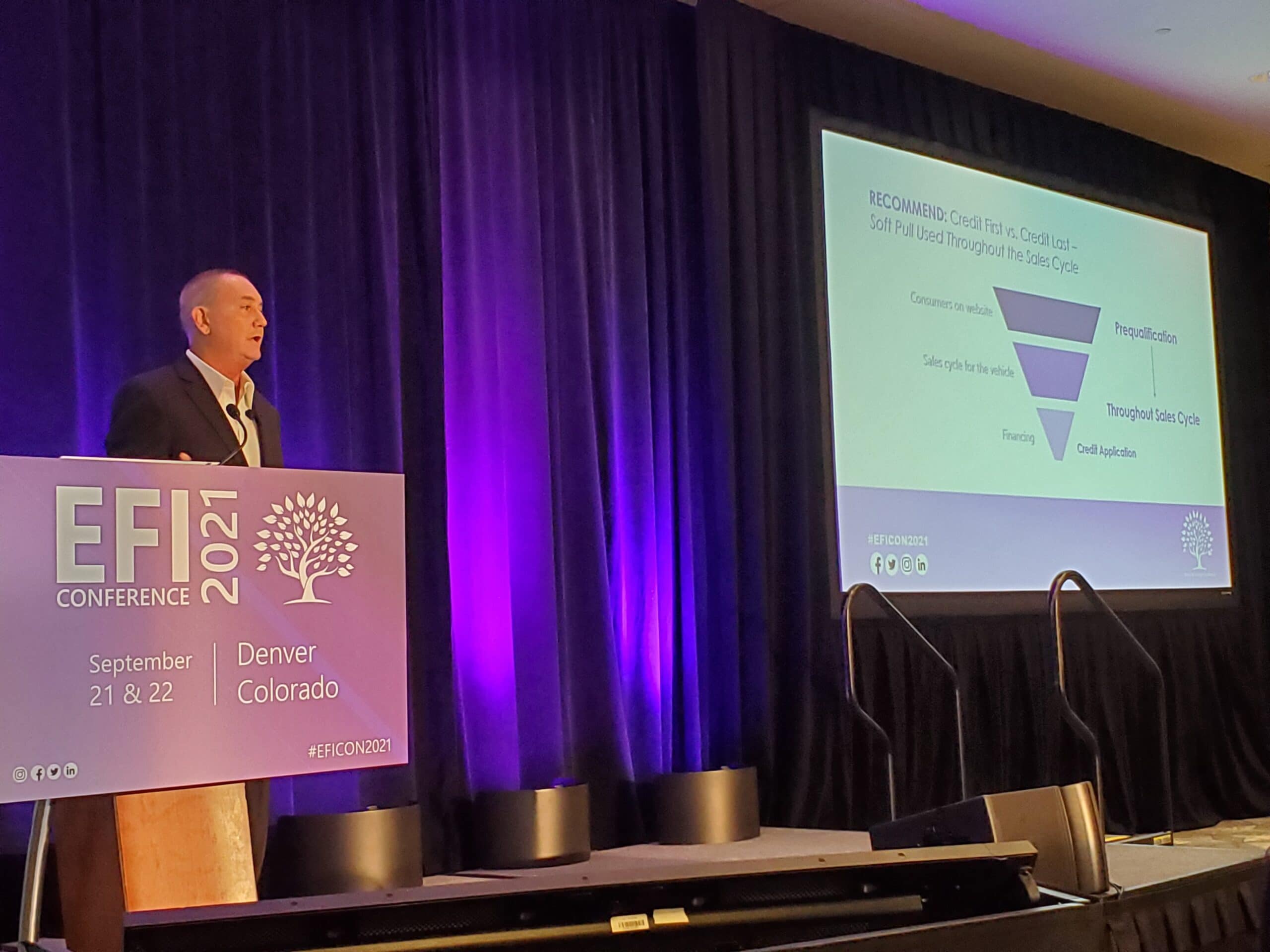

Lettis told the Ethical F&I Managers Conference in September a common form of soft pull would be the preapproval notices from credit card companies. Soft pulls require only a name and address; the consumer doesn’t need to disclose their birthday or Social Security number, Lettis said.

Two types of soft pulls exist: A lender or dealership can request a consumer’s credit information unilaterally with what’s called a “prescreen;” or the consumer can consent to seek a “prequalification,” according to Experian. The former is governed by the Fair Credit Reporting Act, according to Experian.

Hill called a soft pull a “top of the funnel” process that can help customers and dealerships avoid surprises once it’s time for the hard pull at the end of the process. (700Credit doesn’t recommend that dealerships skip the hard pull, he said, citing reasons including compliance factors, greater accuracy and inability to get soft pull records on some people.) A customer and salesperson won’t spend time planning for a vehicle purchase involving $250 monthly payments only to find out that lenders will require $350 a month, according to Hill.

“It’s tough to recover from,” Hill said. Better to adjust at the top of the sale rather than at the end of it, he said.

A similar issue can arise with online retail channels that promise a lower payment than the customer ultimately gets, Lettis said. Soft pulls can permit accuracy from the start and get the ball rolling.

Dealerships have “been doing it backwards for all these years,” Lettis said.