Auto dealers and their manufacturing partners have long recognized the value of F&I (Finance and Insurance) products in enhancing customer satisfaction and safeguarding the investments consumers make in their vehicles. However, the economic landscape of 2023 has prompted dealers and manufacturers to view F&I as a critical component of their profit centers. In addition, F&I has emerged as a means to preserve bottom-line profits that are being eroded by various aspects of the business.

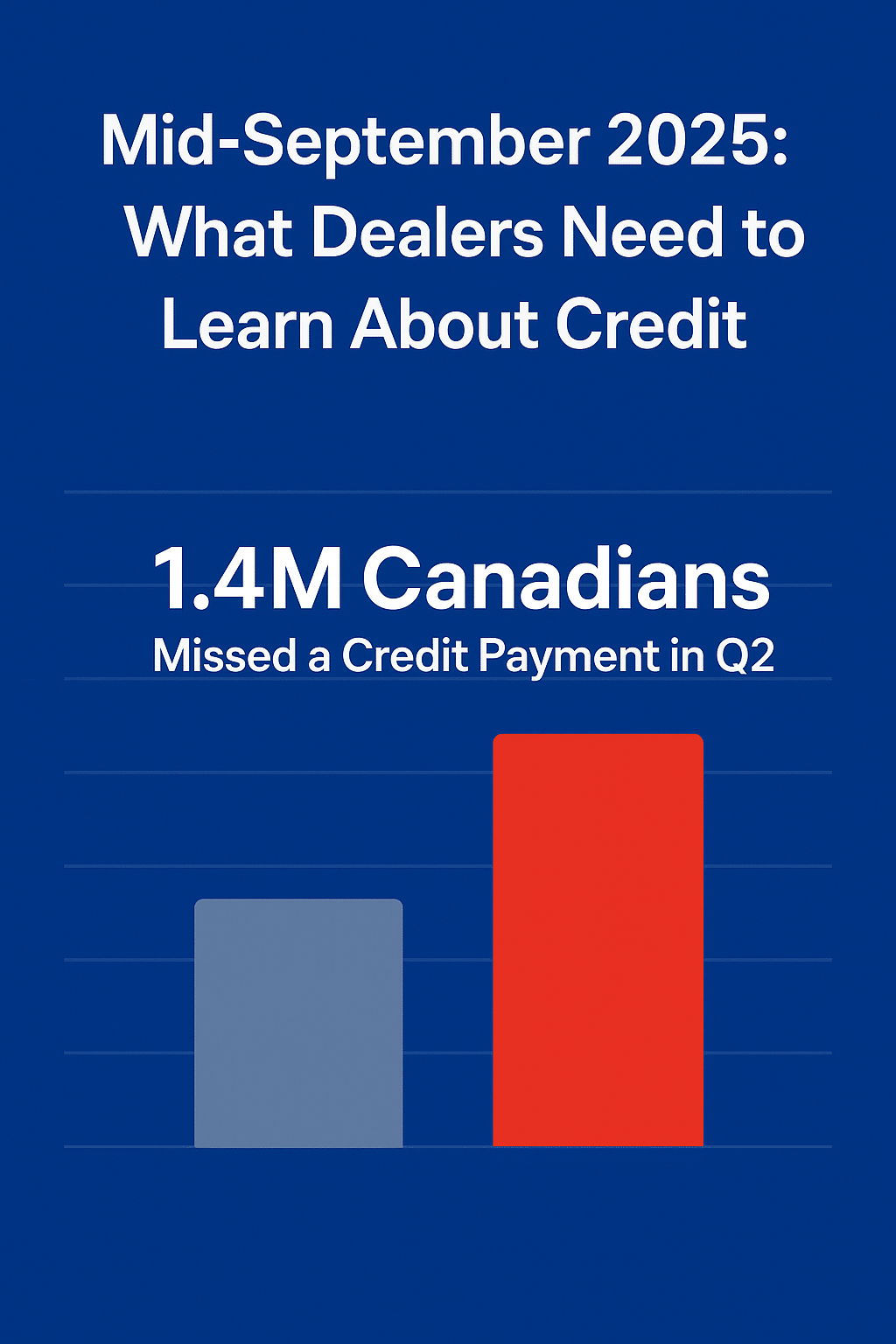

One of the key reasons dealers are exploring ways to boost revenue from the sale of F&I products is the declining overall profits on vehicle sales. According to a recent report by Haig Partners, dealership profits reached an estimated $6.5 million per location for public auto retailers, more than three times the pre-pandemic levels. However, it is believed that profit levels for new and used vehicles are now starting to decline. Profit erosion is also impacting retailers’ fixed operations and service centers, while macroeconomic pressures are slowing demand for vehicle purchases. The report indicates that dealers expect overall profits to fall by 10% to 15% during 2023.

Another factor putting pressure on profits is the rise in incentives. Dealers and Original Equipment Manufacturers (OEMs) are closely monitoring profits, especially as higher interest rates dampen consumer demand for vehicles. In March, Cox Automotive reported a significant shift as the average price Americans paid for a new vehicle fell below the manufacturer’s suggested retail price (MSRP) for the first time in 20 months. The average transaction price of a new vehicle in the U.S. dropped to $48,008, a month-over-month decrease of 1.1%. Additionally, auto manufacturers’ incentive spending rose to the highest level in a year, reaching 3.2% of the transaction price compared to 3.0% in February.

Furthermore, dealers are facing challenges with floor-planning credits. Floor-planning is a financing instrument that allows dealers to finance the vehicles they display and sell to customers. In the past, floor-planning served as a profit center for dealers, benefiting from lower borrowing rates and assistance from automakers in offsetting interest costs. However, as interest rates increase, dealers are required to finance more inventory over longer periods, leading to higher floor-planning costs. This creates a pain point for dealers throughout the industry.

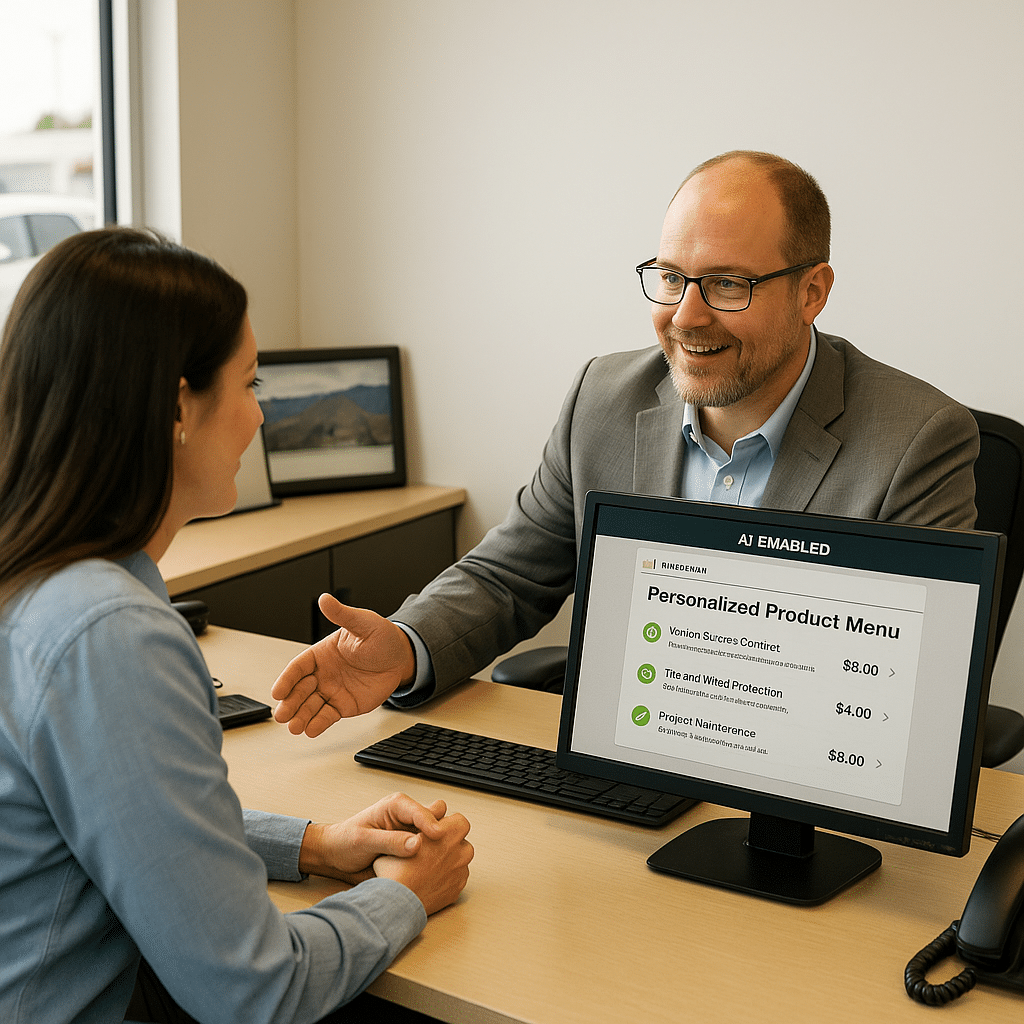

To offset declining profit levels, dealers are turning to F&I product options. Recent consumer shopping trends highlight changing preferences and a growing demand for products such as Guaranteed Asset Protection (GAP) coverage, vehicle protection plans, interior/exterior appearance protection, and tire and wheel protection. The prolonged high prices of vehicles are causing consumers to hold onto their vehicles longer, with 37% of people surveyed stating that they plan to keep their vehicles longer due to the pricing climate. Additionally, 39% indicated that they might hold onto their vehicles longer but remain uncertain. As a result, consumers are increasingly recognizing the importance of F&I products in protecting their vehicles and are actively researching and shopping for these offerings.

Dealers stand to benefit from this shift in consumer demand by recognizing the opportunity to build long-term satisfaction ratings with their customers. By offering F&I products that cater to their needs, dealers can not only enhance customer satisfaction but also offset the profit margins lost in other areas of their operations. It is becoming clear that F&I products, including protection plans and GAP coverage, along with ancillary products that safeguard vehicle appearances and deter theft, hold significant importance to consumers. Therefore, dealers should capitalize on this trend to both satisfy their customers and mitigate profit losses in other sectors of their business.