SCHAUMBURG, Ill. – By SubPrime Auto Finance News Staff. Access the Experian State of the Automotive Finance – Q3 2021 presentation here.

More evidence of how rising wholesale and retail prices are landing within finance company portfolios arrived on Thursday.

According to Experian’s latest State of the Automotive Finance Market report, the average amount financed for a used vehicle jumped more than 20% year-over-year during the third quarter. Experian pegged it at $25,909 in Q3 2021, up from $21,622 in Q3 2020.

That amount financed pushed the average monthly payment higher on those used-vehicle originations, too, rising from $401 to $465 over the same timeframe.

On the new-vehicle side, Experian spotted increases there, as well, but not quite as dramatic as used vehicles.

Experian said the average amount financed for a new model delivered in Q3 came in at $37,280, up from $34,682 in Q3 2020. That figure pushed the average monthly payment up to $609 from $565.

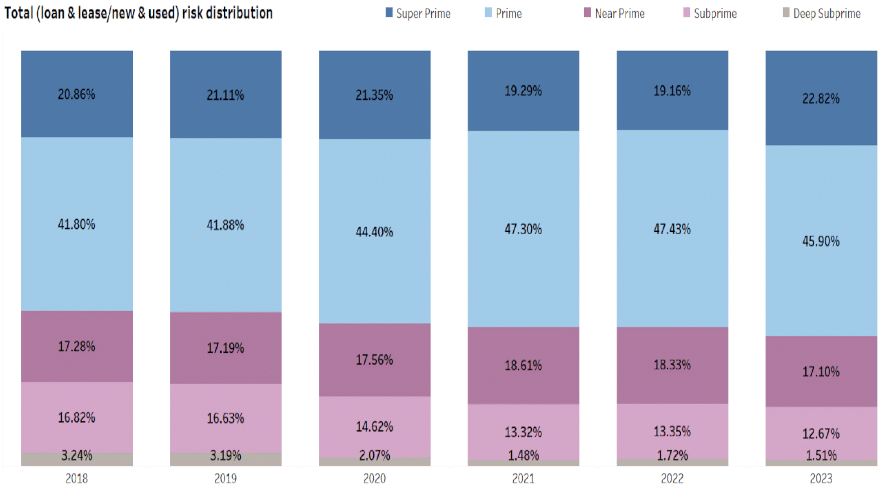

With the ongoing inventory shortages disrupting the industry and causing vehicle prices to increase, Experian said some industry pundits have affordability concerns. However, Experian replied saying it’s notable that 30- and 60-day delinquency rates remain low.

The report indicated 30-day delinquencies saw a minimal uptick during the quarter, increasing to 1.66% compared to 1.65% in Q3 2020, while 60-day delinquencies remained flat at 0.55% year-over-year.

In addition to the year-over-year stability, Experian pointed out that these numbers remain notably lower than pre-pandemic levels. In Q3 2019, the 30-day delinquency rate was 2.35% in Q3 2019, while the 60-day delinquency rate was 0.79%.

“Vehicle prices have been on the rise for some time, so it’s a positive sign to see delinquencies remain so stable. Consumers are demonstrating their ability to manage these larger loans and higher monthly payments,” Experian senior director of automotive financial solutions Melinda Zabritski said in a news release.

“With the sizable increases that we’ve seen in loan amounts this quarter, delinquencies will be an important metric to monitor in the quarters to come,” Zabritski continued.

In addition to lower delinquency rates, Experian mentioned another positive trend has been the continued decrease of interest rates both for new- and used-vehicle financing.

During the third quarter, the average interest rate for a new-vehicle installment contract decreased to 4.05% from 4.23% in Q3 2020. Experian added that the average interest rate for used vehicles saw a similar decrease year-over-year to 7.98% from 8.39%.

Read-on here.