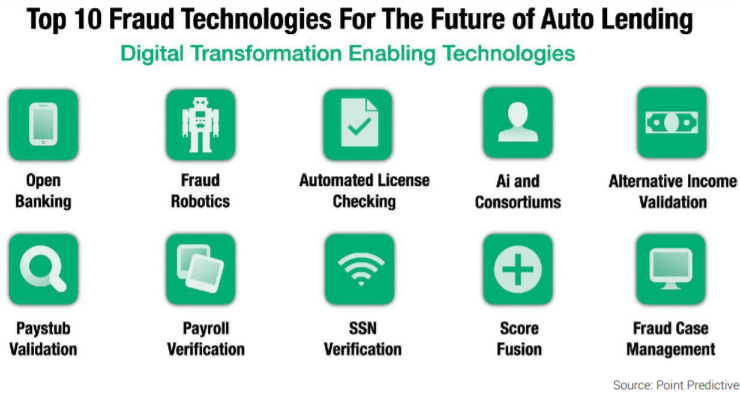

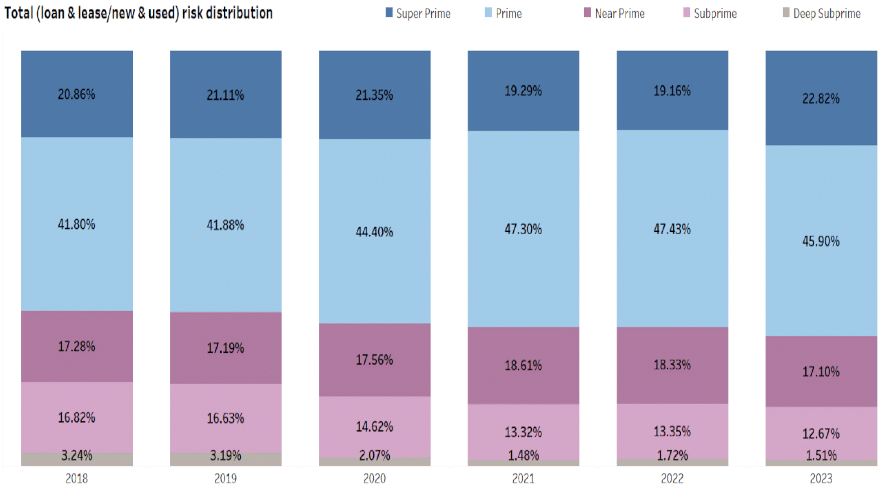

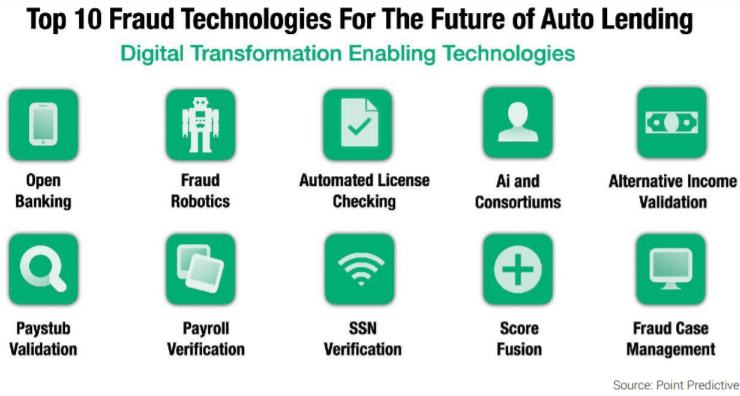

SAN DIEGO (AutoRemarketing) — The future is here. And it’s digital. We are in the middle of a digital transformation — and it’s all being driven by the demand for speed and convenience. Faster decisions, faster funding. And fast money as we know all too well can always leads to fast fraud if you’re not careful. But the good news is that we don’t need to slow down, we can move fast but we need to put some protections in place proactively. Th e speed change in the auto industry is mind blowing, so if you are not actively thinking about how to plan for it now — you might quickly find your fraud strategy irrelevant in this newer and faster paced world. My advice for this new world? Pay attention to these Top 10 trends in technology that are very likely to become part of your fraud prevention strategy in the next 36 months.

No. 1: Open banking to tap directly into bank account data

Bank statements and pay stubs are notoriously subject to high rates of forgery and manipulation. But technology like open banking is changing all of that. Open banking is the system of allowing access to a consumer bank and transaction information through third party applications. Th is technology will off er both auto lenders and car dealerships the ability to directly download a readable copy of a borrower’s bank account information going back six to 12 months. No more faxed copies provided by borrowers. Th is data comes directly from the bank. Companies like TurboPass are leading the charge in this area, helping to give lenders and dealers more reliable bank statements and avoid fraud.

No. 2: Fraud robotics to root out fraud patterns across loans

Robotic Process Automation (RPA) is a form of business automation which uses artificial intelligence to perform repetitive task that require lots of logic. And these robots are now being used by companies like GM to create chatbots to help consumers with their questions, and other companies like Point Predictive to help root out fraud from billions of individual pieces of data. Fraud robots have arrived, and you can employ them now in a variety of ways to better manage and control your auto lending fraud.

No. 3: Automated driver’s license verification to stop the fakes

Fake driver’s licenses are used thousands of times each month to fool dealerships and lenders into loaning to identity thieves. And that’s because people are not that good at spotting the fakes. But artificial intelligence is promising to change all that. Across the U.S., banks and finance companies are flocking to automated technologies that can safely and securely scan a consumers driver’s license and accurately identify if it is genuine through a series of optical and data driven forgery test. And it works brilliantly. Auto lenders and dealerships here in the US will soon begin to use this as the standard modus operandi versus the current dated techniques of scanning copies of consumers drivers’ licenses on fax machines. Companies like Mitek are leading the way with this new and emerging technology.

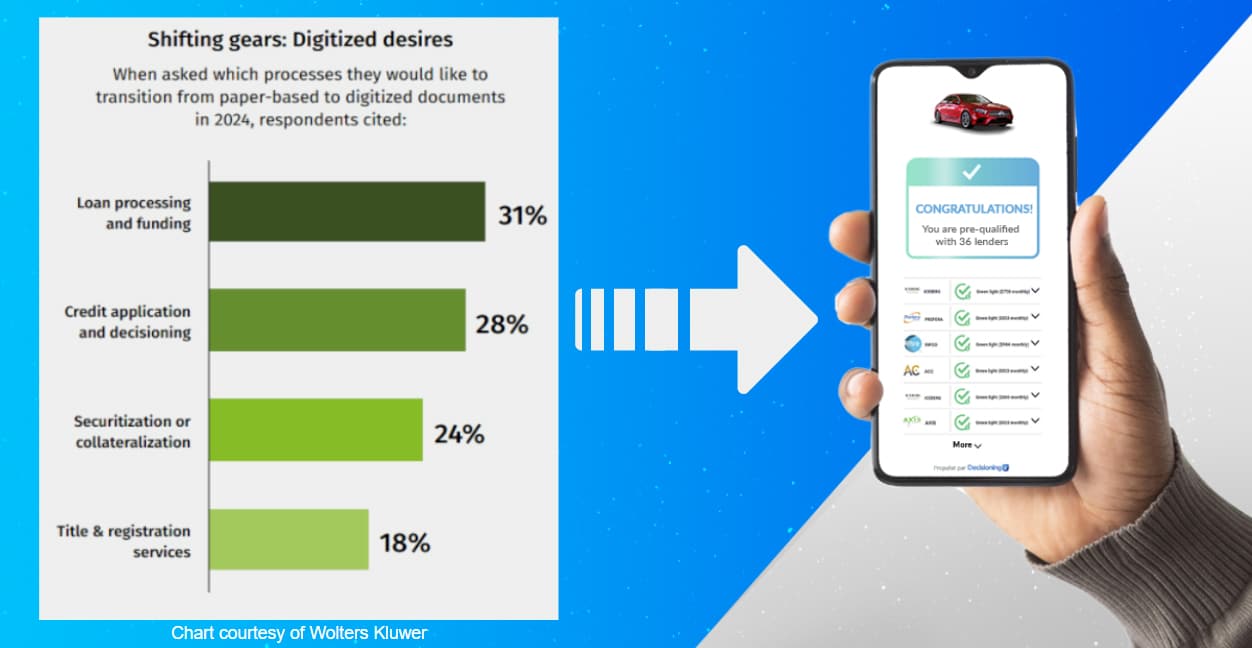

No. 4: AI for decision automation to reduce manual verification

Auto lending in comparison to other industries still requires high levels of manual verification before funding loans. For most lenders, between 25% to 100% of loans require some manual underwriting or stipulation review to get a loan through funding. And that is simply not going to cut it in the new modern world. To solve this issue, lenders are turning to artificial intelligence and alternative data to systematically reduce the amount of work requiring human intervention. And it works amazingly well, with some lenders achieving increases in automated verification of 30% or greater on their loan portfolios.

The Lucy F&I Platform helps dealerships get the best lender choices for every consumer in just a few seconds. Lucy brings decision automation to F&I managers.

No. 5: Alternative income validation using AI and historic data

Income validation has always been one of the most time consuming, painful and expensive task for auto lenders. To date, lenders have had to rely on expensive database checks that can run as high as $30 a loan, or request for paystubs from borrowers which are often faked or forged. New technologies that leverage historic data and machine learning are finally giving lenders a break from those onerous and expensive options. Alternative income validation with data and Ai, is the only true frictionless and behind the scenes method that does not require any interaction with borrowers to validate their income. And testing has shown that it works amazingly well, enabling lenders to alternatively validate between 30% to 75% of their stated incomes automatically.

No. 6: Automated paystub validation to scan stubs and match to fraud and forgery patterns

Lenders report that close to one in 10 paystubs they receive is a forgery or has been generated on the internet to help consumers apply for loans with false income. But OCR technology is now being employed in the fight against fraud. Th e technology enables lenders to scan paystubs, and have software forensically identify any fakery or manipulation. Th e software is trained to spot forgery patterns based on thousands and thousands of fake and internet generated paystubs that it has seen in the past. And the technology works, with some companies boasting that the software can identify twice as many fakes that human experts often miss.

No. 7: Consumer permissioned payroll verification to augment the work number

The Work Number has long been the only game in town to verify borrower’s employment automatically from participating employers. But that is changing with new technologies from companies like Plaid which will now off er borrowers the ability to give lenders access to their paystubs directly from their employer. Th e only hitch? Borrowers will need to remember their usernames and passwords to their payroll records which means that it might take some time for them to adopt this new service.

No. 8: Real-time Social Security Number validation to stop synthetic identity fraud

Synthetic identity fraud is the fastest growing financial crime here in the U.S., and it’s expected to balloon to over $2.5 billion in annual losses by 2023. To curb that fraud, the Social Security Administration has launched a new real-time CBSV service that can validate that the Social Security Number belongs to the borrower by matching the name on the application to their historic records. Th e new service accepts digital signatures which means that this fraud check can now be easily integrated into the existing application process to clear more identities as genuine.

No. 9: Score fusion to leverage multiple fraud solutions together

Two heads are better than one. It’s a saying that you have often heard and it’s particularly true when it comes to fraud detection. AI companies like Point Predictive are perfecting and optimizing methods which enable lenders to fuse their multiple scores coming from different vendor solutions together into one super fraud score. And the technique works, enabling lenders to boost their detection of risk by 30% or more versus using the scores separately.

No. 10: Fraud case management to create operational efficiencies and better fraud reporting

Fraud case management has been used by other financial services industries for the last 30 years, but it is a technology that auto lenders have not used. Instead, many auto lenders have relied on low tech techniques like excel and other desktop solutions to track fraud. But that will soon change. Over the next three years, auto lenders will adopt this technology to create more scalable and efficient fraud operations. Fraud case management will provide queue management, rule writing capability, suspicious case management and fraud reporting all under a single application for all underwriters and risk managers. Auto fintech will drive frictionless funding and more trusted relationships While the online world can be an ominous and murky world of fraud risks, it doesn’t have to be. Good technology at its core has always been make things easier and that is certainly no exception now.

If you want to be a part of the digital transformation and grow your portfolio safely, you should consider arming yourself with an array of these technologies. Onward and upward! Frank McKenna is the chief fraud strategist at Point Predictive, which helps automotive, mortgage, retail and personal loan finance companies to identify the consumer applications with truthful and reliable information.